USE CASES

Offering AI-powered payment matching, automated reconciliation, and collections forecasting, the Invoiced platform allows organizations to accelerate month-end financial close, manage cash flow more effectively, and tap into key insight for better decision-making. Invoiced is seamlessly integrated with the Flywire global payments network, enabling zero-touch processing for complex payment types, including bank transfers.

Automate with Invoiced to fast-track cash applications, minimize the risk of reconciliation errors, and access funds more rapidly.

With the right automation platform, you can experience the benefits of cash application and reconciliation, which are fast, easy, and error-free.

When businesses received payments primarily via paper checks, applying them to the appropriate accounts and invoices was straightforward. With so many diverse payment methods—including ACH transfers, credit and debit cards, wire transfers, and online platforms—make cash application more complicated. For organizations handling it all manually, it can be a slow, resource-intensive, and error-prone endeavor.

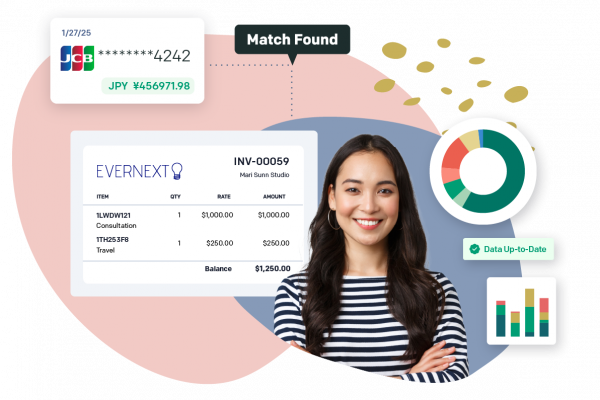

Invoiced frees organizations from time and effort spent manually applying incoming customer payments to their outstanding invoices by fully automating the cash application workflow. With its proprietary CashMatch AI algorithm, the platform accelerates and streamlines cash applications while eliminating human error from the payment matching process.

A/R accounts reconciliation—which verifies customer payments against the amount invoiced within a certain period—is a time-consuming business operation that must be performed manually. Still, many companies tackle the process independently at the end of each billing cycle. In addition to absorbing valuable time and resources, handling accounts reconciliation manually introduces the possibility of costly human error.

With the Invoiced platform, your organization can automate account reconciliation, turning an arduous manual task into an easy, error-free process. Streamlined workflows scale with your business so you can count on fast, accurate reconciliation as your transaction volumes grow.

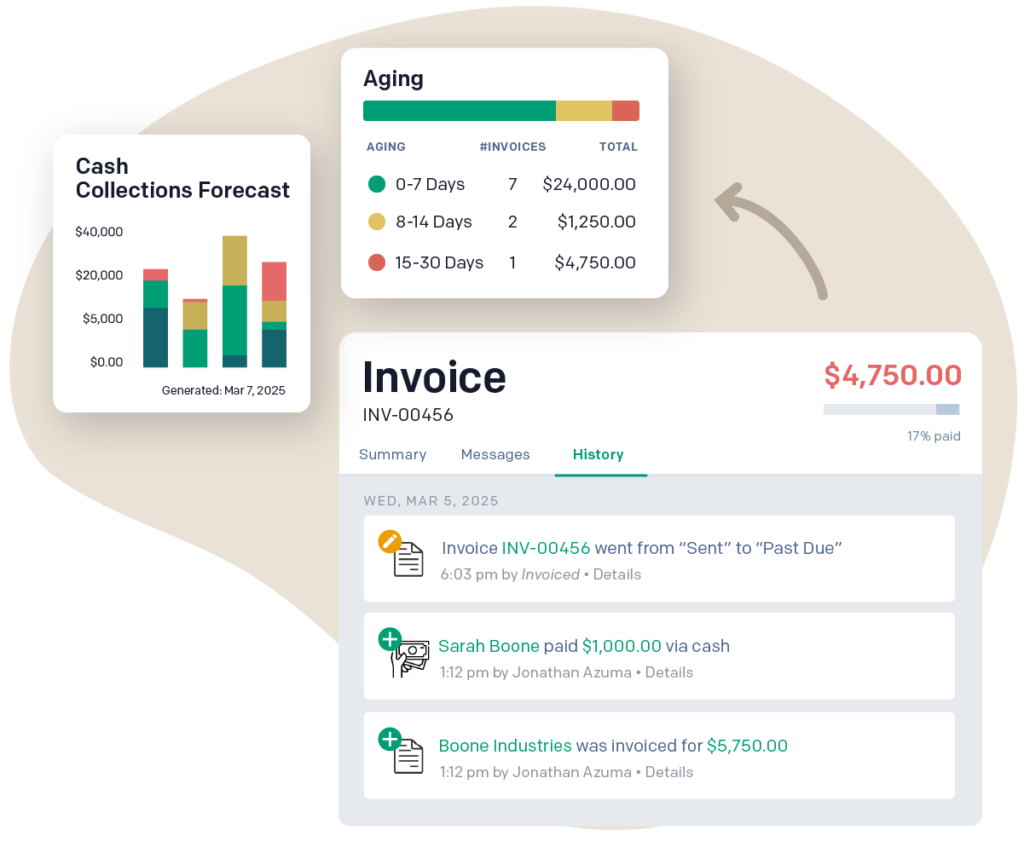

To manage cash flow effectively, companies need quick access to up-to-date customer payment and collection information. If current, reliable data is lacking, finance teams may not have the insight to make critical business decisions.

The Invoiced platform is designed to track invoice status across the payment lifecycle and keep accounts updated in real-time. It also uses data from invoices, autopay, payment plans, promises-to-pay, and customer account history to provide highly accurate collections forecasting. With clear insight into collections performance, companies know when to expect payments and which accounts require additional attention to reduce DSO.

When a month-end accounting close is efficient, a company can tap into financial data for timely analysis, decision-making, and reporting. However, if processes for reviewing and reconciling monthly transactions are performed manually, the operation can become lengthy and error-prone, delaying access to vital information.

Businesses can close their books faster by automating cash application and reconciliation workflows with Invoiced. In addition to freeing valuable A/R resources for other efforts, automated reconciliation allows organizations to access accurate, up-to-date financial information more quickly.

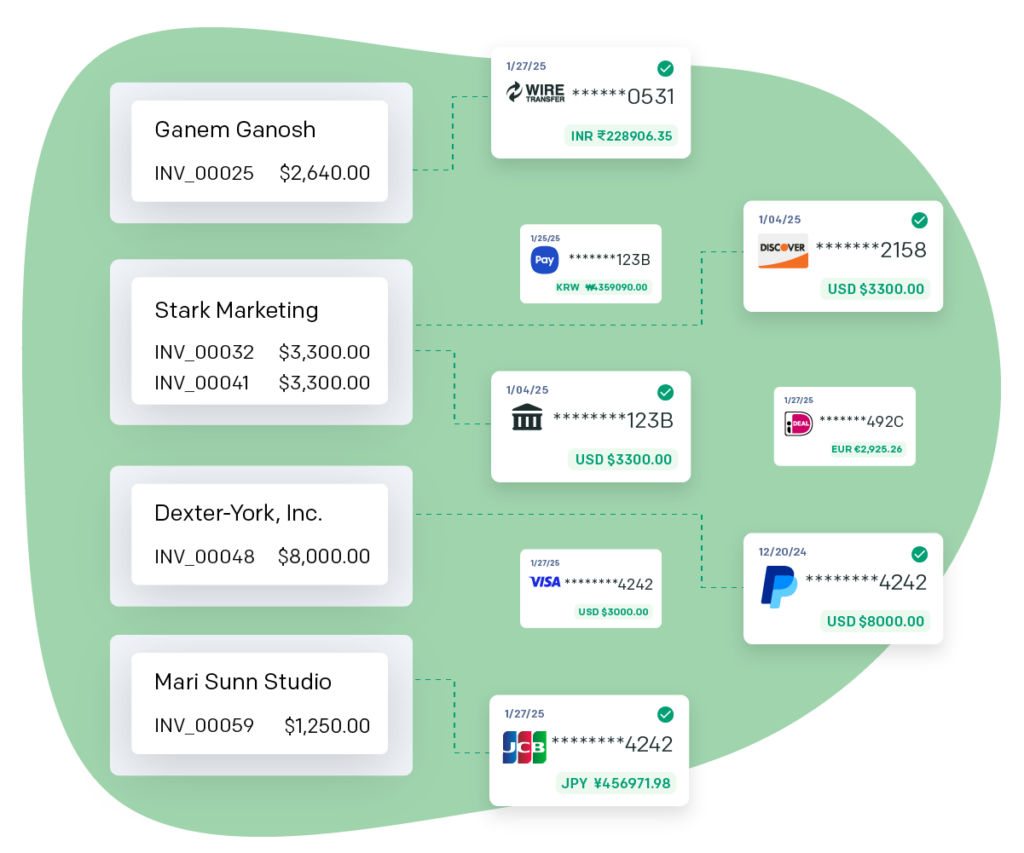

The Invoiced platform uses its proprietary CashMatch AI algorithm to match incoming payments with outstanding invoices. Cash Match AI intelligently analyzes customer identifiers, invoice numbers, payment amounts, and other reference information to direct funds to the appropriate invoices.

When a client pays online via the Invoiced customer portal, the Invoiced platform processes and reconciles payments almost instantly. (Direct debits may require a few business days to clear, delaying reconciliation.)

Yes, Invoiced handles a variety of payment methods, including ACH, cash apps, checks, credit cards, direct debit cards, virtual cards, and wire transfers.

The Invoiced platform’s AI-powered cash application functionality intelligently analyzes incoming payments to match and apply them to outstanding invoices. CashMatch AI applies partial payments to the appropriate open invoice, allowing users to review and adjust the application as needed. It records a credit balance in the proper account for overpayments, allowing the customer to apply the payments toward future invoices.

Yes, the Invoiced platform is designed for seamless integration with other accounting and ERP systems, including NetSuite, QuickBooks, Sage Intacct, and more. Connecting Invoiced and your ERP application can improve your process efficiency, reduce costs, and provide centralized data access to teams across your business.

CashMatch AI enables the Invoiced platform to manage payment discrepancies intelligently. When a customer submits a partial payment, Invoiced identifies the appropriate invoice and applies the funds toward the balance. When a customer submits an overpayment, Invoiced adds a credit balance to the account for future invoices.

If Invoiced cannot apply a customer payment to an invoice, the platform will contact your customer according to the notification schedule and communications you configure in your settings.

Invoiced auto-generates recurring or subscription-based invoices for each billing cycle, performs seamless automated matching of incoming customer payments to those invoices and reconciles the payments for you upon receiving them.

Yes. With global payment processing enabled in the Invoiced environment, you can easily bill and receive payment from your international customers in their local currencies.

When you automate and streamline your reconciliation workflow, you speed up your month-end close process and eliminate the risk of human error, ultimately leading to faster and more accurate financial reporting.

Invoiced is integrated with the Flywire global payments network. If you utilize this payment network, Invoiced will automatically pick up any bank deposits and apply those payments to the appropriate invoice.