USE CASES

When customers fail to pay on time, it creates serious financial issues for your business. Adding late fees to your invoices is a proven strategy for reducing overdue payments, but rebilling customers requires valuable time and resources. With the Invoiced accounts receivable (A/R) platform, you can implement an automated late fee policy with minimal effort, freeing up your team for higher-priority projects.

With Invoiced, you can incorporate late fee charges in your billing quickly and easily. Just set up a schedule for charging fees, select your parameters, and you’re off and running.

Set up your late fee schedule, select the options that work for you, and automatically apply late payment charges to all future invoices.

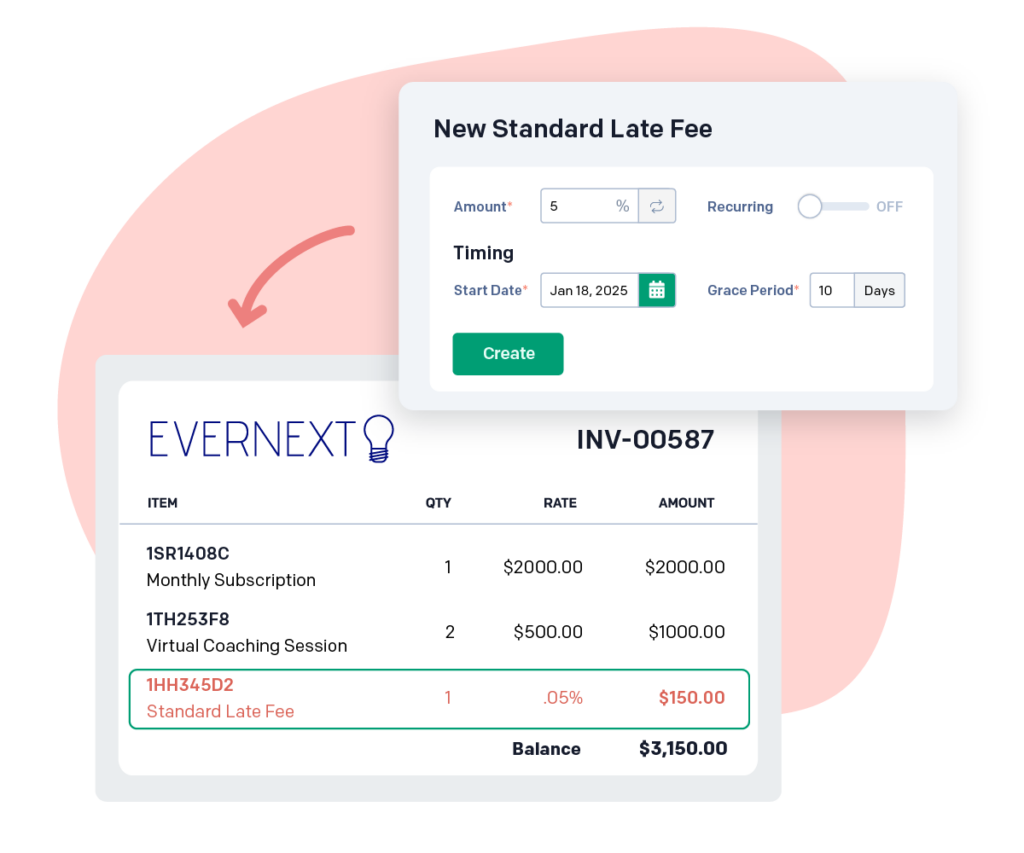

Managing late payments at Invoiced is easy with our automated late fee application. Simply set up a custom late fee schedule for your business, choosing a flat fee or percentage, along with a grace period and start date. Once configured, the system will automatically apply late fees to all future invoices for that customer, saving you time and reducing manual effort.

You can apply fees at regular intervals and adjust the timing if needed. Late fees are added as a separate line item, and if a client makes a late payment, the system ensures they’re billed appropriately. Plus, it’s easy to waive or disable late fees on specific invoices when necessary.

With late fee automation at Invoiced, you’ll streamline your invoicing process, improve cash flow, and eliminate the hassle of manually tracking overdue payments. Set it up once, and let the system do the rest.

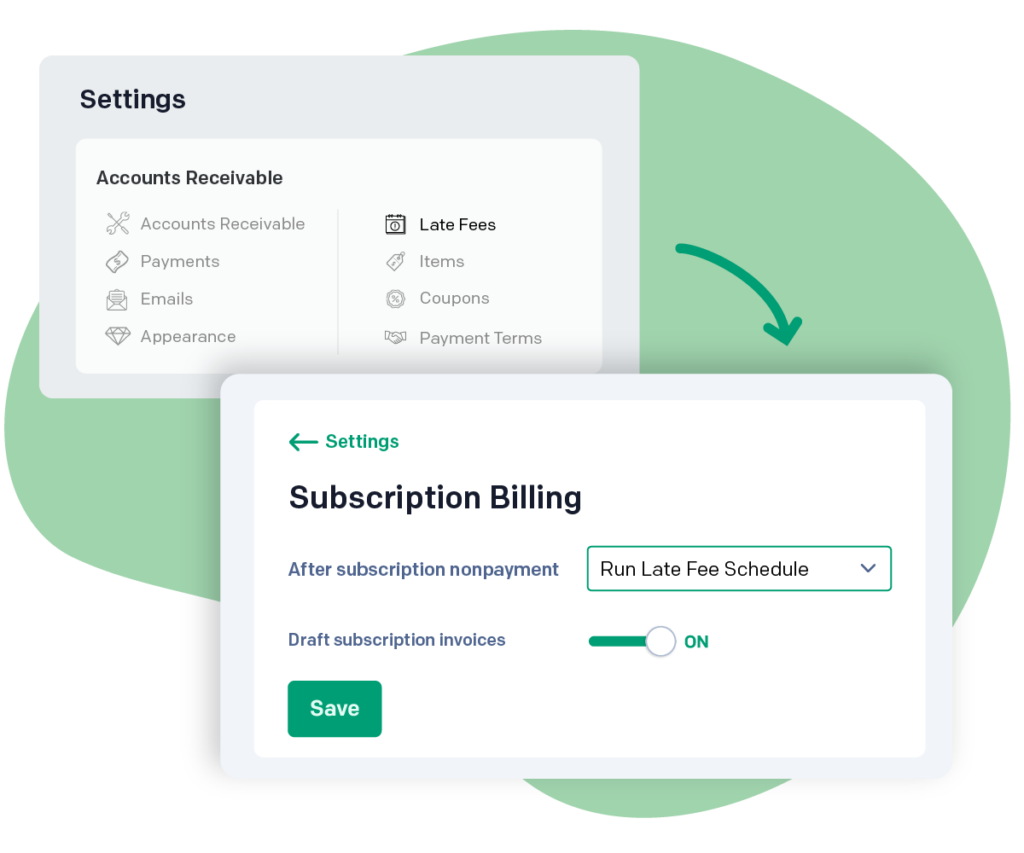

Even if your company uses subscription-based billing, Invoiced simplifies the management of late payments. Whether your subscription model is tiered, fixed-rate, usage-based, or a hybrid, you can set up a custom late fee schedule that applies automatically to overdue invoices.

As with service-based late fee application, you only need to define the fee amount, grace period, and start date, and the system will handle the rest. Your late fees will be applied consistently across all invoices for each customer based on the rules you set, reducing manual tracking and ensuring timely payments. Whether you have recurring charges or one-time fees, Invoiced ensures that your clients are billed for any overdue balances without tedious manual effort on the part of your team.

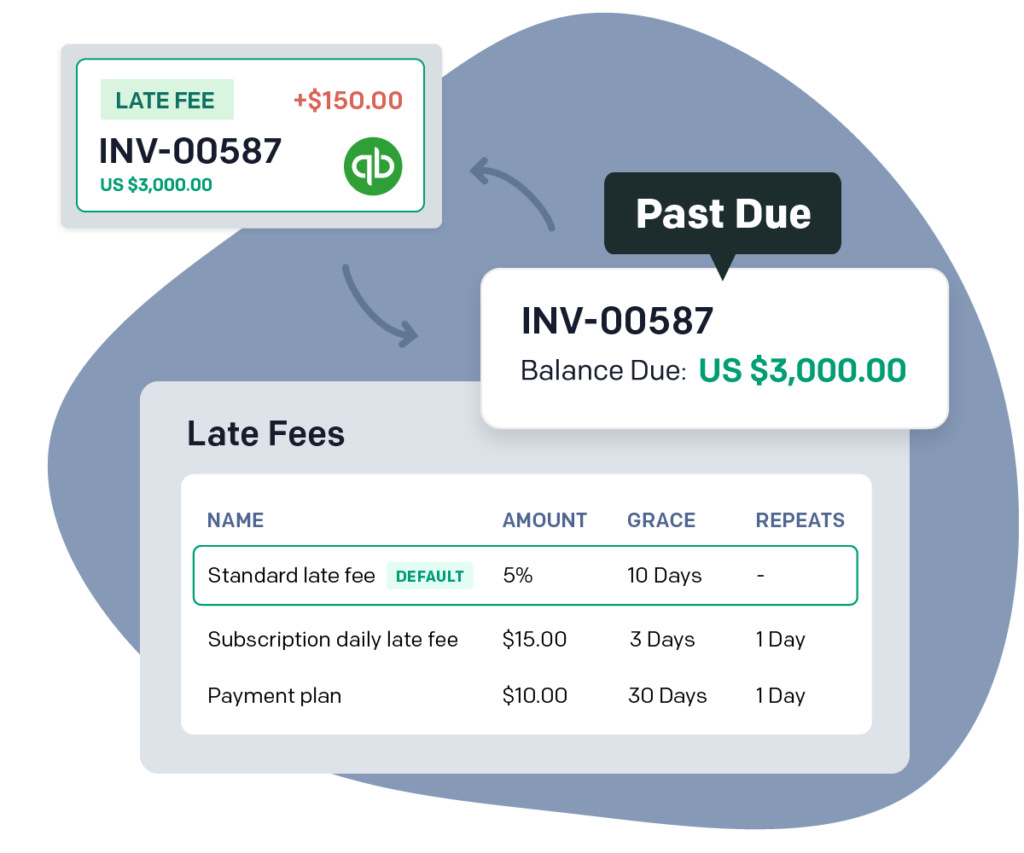

Planning to integrate Invoiced with an ERP? You can still apply late fees seamlessly with Invoiced. Let’s take QuickBooks as an example. Simply create your original invoice in Invoiced, and when a late fee is applied, your invoice is automatically updated. This update will sync to QuickBooks, keeping your accounting records accurate and up to date.

Now, you can focus on growing your business while Invoiced handles the details of billing and late fee automation, keeping your invoicing and accounting processes perfectly aligned.

When you don’t receive timely customer payments, you may not always have sufficient funds to keep your operations up and running. Charging late fees helps you get paid on time, and with Invoiced, it’s quick and easy to set them up.

For every invoice that’s past due, your business has to invest valuable time and effort in seeking payment. When you assign a late fee schedule to a customer in the Invoiced environment, you free your staff from hours spent calculating the appropriate charges and reaching out to delinquent customers.

You may not want to implement an iron-clad policy without exceptions when charging late fees. After all, a long-time customer may have a legitimate issue requiring a payment extension. With Invoiced, you can easily disable late fee charges on an invoice-by-invoice basis, allowing you to accommodate special circumstances as needed.

The type and amount of late fees you charge can depend on your region, your industry, and the administrative costs you hope to cover. The Invoiced platform allows you to set the parameters for collecting late fees, including whether you charge a flat rate or a percentage, the length of your grace period for overdue payments, and how often you’ll assess charges on overdue invoices.

Yes, you can disable late fees for a specific invoice by turning off the Late Fees toggle within the Invoiced platform. If you need to remove a late fee that has already been assessed, you can edit the invoice and remove the line item.

Yes, when you configure your automated late fee process in the Invoiced environment, you set your desired grace period for overdue payments, if applicable.

Yes. If your accounting tools aren’t currently connected to Invoiced, it’s easy to integrate them. After integrating your platforms, late fees added to invoices created in the Invoiced environment will be carried over to your other accounting systems.

Yes, you can configure Invoiced late fee automation for most business models, including traditional, tiered, fixed-rate, usage-based, and subscription offerings.

The Invoiced platform applies late fees to invoices that:

Yes. You can create multiple late fee schedules, and assign them to different customer groups.

You can use chasing to create automated email reminders with customized templates, and set the same schedule for emails and late fees.

Yes, email templates in Invoiced are customizable, and can include information about late fees.

Yes, partial payments can be applied to invoices at any time. Percentage based late fees are calculated using the invoice balance.

Invoiced was designed for users across many industries and locations. Our late fee features are customizable to fit a wide variety of requirements. Users should configure them according to their specific industry standards.