USE CASES

But with the right tools, it can be a boon to your business, driving down days sales outstanding (DSO) and keeping your cash flow steady. When you automate your collections with Invoiced, you transform laborious dunning efforts into a streamlined and highly efficient workflow for getting paid more quickly.

Designed to streamline and accelerate collections, the Invoiced platform can help your business significantly reduce your invoice-to-cash lifecycle.

With Invoiced, your business can optimize its dunning processes with automated, customized cadences for collecting payments more quickly, efficiently, and reliably.

Receiving timely payment for your products and services is critical for the health of your business, but following up on open invoices can be tedious and time-consuming. The right automation solution frees your organization from hours spent chasing funds and optimizes your collections processes.

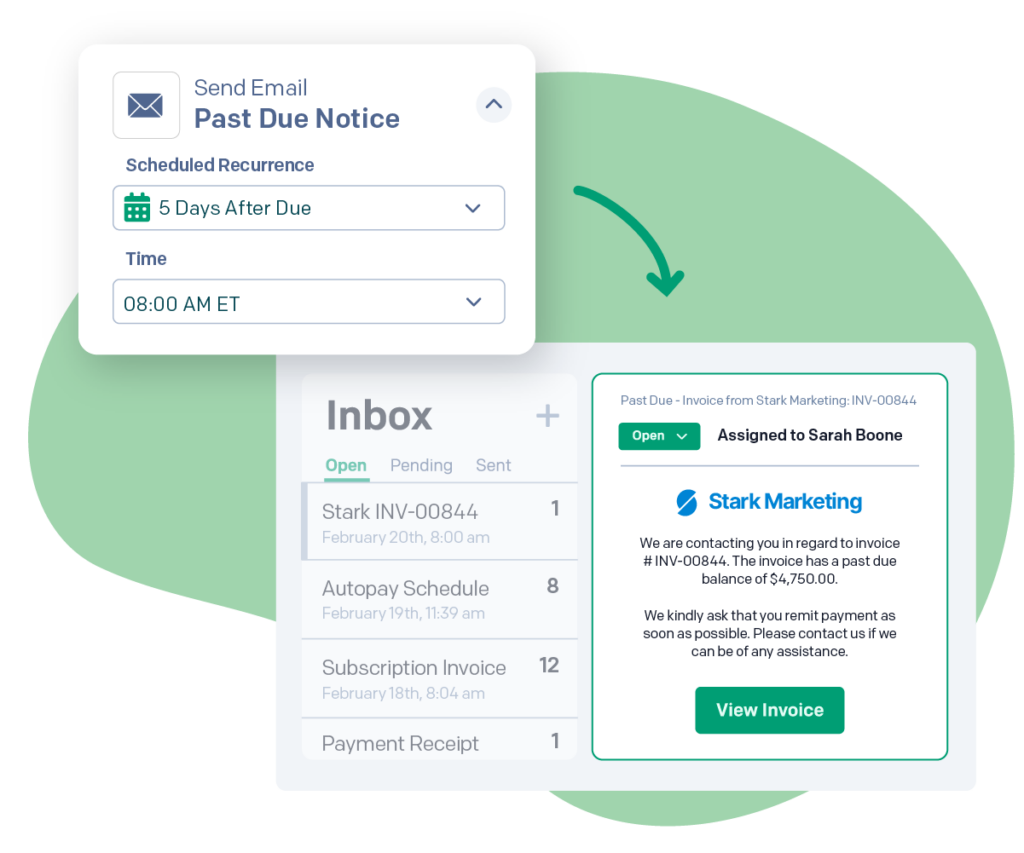

The Invoiced platform offers a sophisticated Smart Chasing feature, which allows you to easily create automated cadences for sending payment reminders and other collections communications. You choose the messaging, channels, and frequency that work for your business, and Invoiced takes care of the rest.

The Invoiced platform is designed for optimal flexibility, providing pre-built templates that allow you to design customized, brand-aligned dunning communications. You can configure dunning cadences to follow up at the customer or invoice levels, choosing the appropriate timing and messaging by segment or by individual account.

To incorporate late fee charges, you configure them to your specifications (start date, amount, flat rate or percentage, length of grace period, etc.) — Invoiced will automatically calculate and add them to your invoices. For further escalation efforts, Invoiced allows you to define the steps to follow up with delinquent accounts (e.g., phone calls, letters, or legal action) and choose when you deploy them in your dunning cadences.

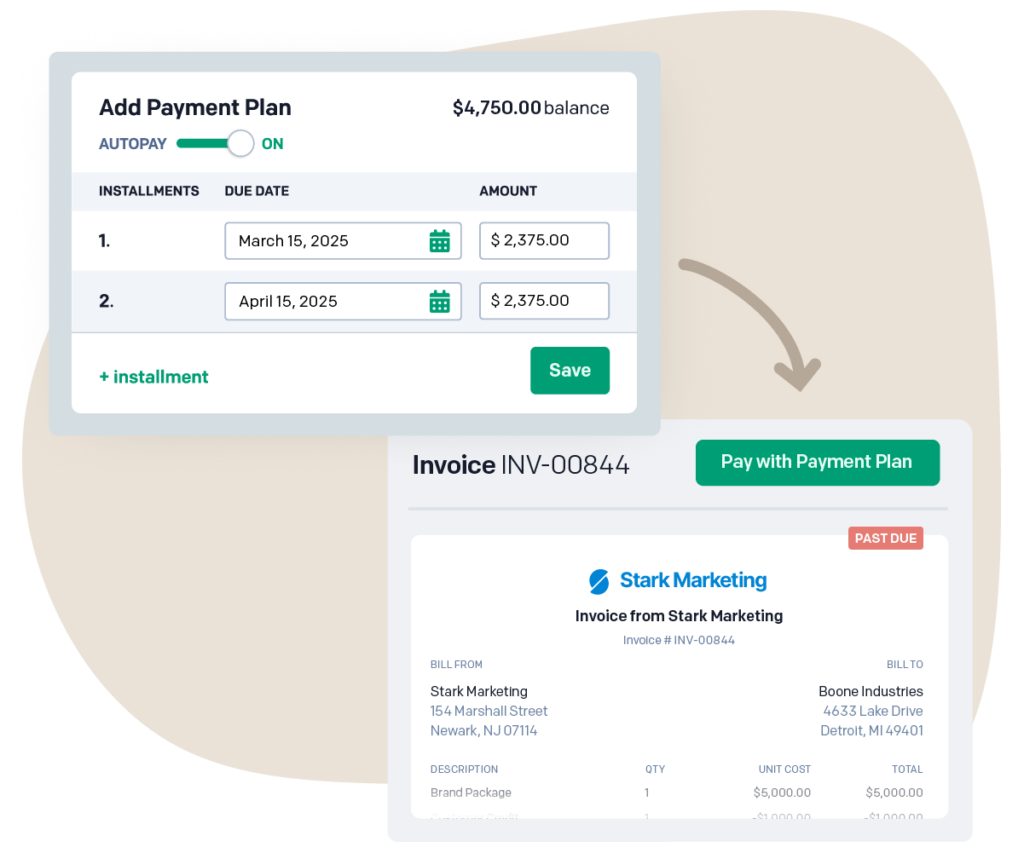

By offering payment plans, your organization can boost sales for big-ticket items, keep cash flowing into your business, and build loyalty with your customer base. And with Invoiced, it’s fast and easy to set up automated schedules for collecting payment installments from your customers.

With a single click, you can add a payment plan to any invoice with an outstanding balance in the Invoiced environment. Our payment calculator will set up the installment plan for you, or you can create your own custom plan. Going forward, Invoiced will automatically enable Autopay capabilities and collect payment according to your newly created installment schedule.

You may send payment reminders and follow up on your company’s past-due invoices, but how effective are your efforts? When you automate your collections with Invoiced, you gain access to the real-time reporting and analytics you need to assess your performance accurately.

With Invoiced, you can analyze aging reports to identify accounts with significantly overdue invoices, monitor the percentage of invoices collected within specific timeframes, and use data visualization tools to understand customer payment behavior. You’ll tap into the information you need to know how well your dunning strategies are working — and identify areas for improvement.

Auto-generate invoices to your specifications using your pre-selected parameters for a customer or account, including payment terms, sales or service items, discounts, taxes, and late fee scheduling. These invoices can also be created in your accounting or ERP system and synced back to Invoiced.

Yes, with Invoiced’s accounts receivable software, you can design dunning letter templates that are aligned with your brand and use your own messaging. And it’s easy to set up schedules for sending automated reminders at your preferred frequency.

Yes, the Invoiced platform is designed for seamless integration with other accounting and ERP systems, including NetSuite, QuickBooks, Sage Intacct, and more. Connecting Invoiced and your ERP application can improve your process efficiency, reduce costs, and provide centralized data access to teams across your business.

By automating collections, the Invoiced platform streamlines and accelerates the processes involved, freeing your business from manual efforts and helping you get paid faster. Plus, with real-time reporting and analytics, you can assess your collections performance and identify areas for fine-tuning.

Yes. With global payment processing enabled in the Invoiced environment, you can easily bill and receive payment from your international customers in their local currencies.

The Invoiced platform accepts various payment methods, including ACH, checks, credit cards, direct debit cards, virtual cards, and wire transfers.

Yes, with the Invoiced platform, you can pause automated reminders for specific customers by adjusting their reminder settings.

Yes, you can apply your company’s own branding to the Invoiced customer payment portal and you can configure the portal’s features to meet your specific needs.

Yes, with Invoiced, you can analyze reports and metrics to better understand customer payment behavior and identify accounts that tend to carry past-due balances.