USE CASES

For your organization to fully reap the benefits of accounting automation, you need a platform designed to streamline and accelerate your invoice-to-cash processes from end to end. Invoiced has you covered — you can automate your entire invoice-to-cash lifecycle to get paid more quickly, slashing days sales outstanding (DSO) and boosting your collection effectiveness index (CEI) while reducing the time and cost associated with cash application and automated reconciliation. You can also tap into our advanced forecasting and reporting capabilities to make well-informed financial decisions for your business.

With Invoiced, simplifying your invoice-to-cash operations is fast, easy, and intuitive. You set the workflows for automated invoice generation, distribution, collections, reconciliation, and custom reporting — Invoiced takes care of the rest.

From automated invoicing and collections to AI-powered reconciliation and on-target forecasting, Invoiced optimizes your invoice-to-cash processes for speed and efficiency—while freeing your accounting team from hours of repetitive tasks.

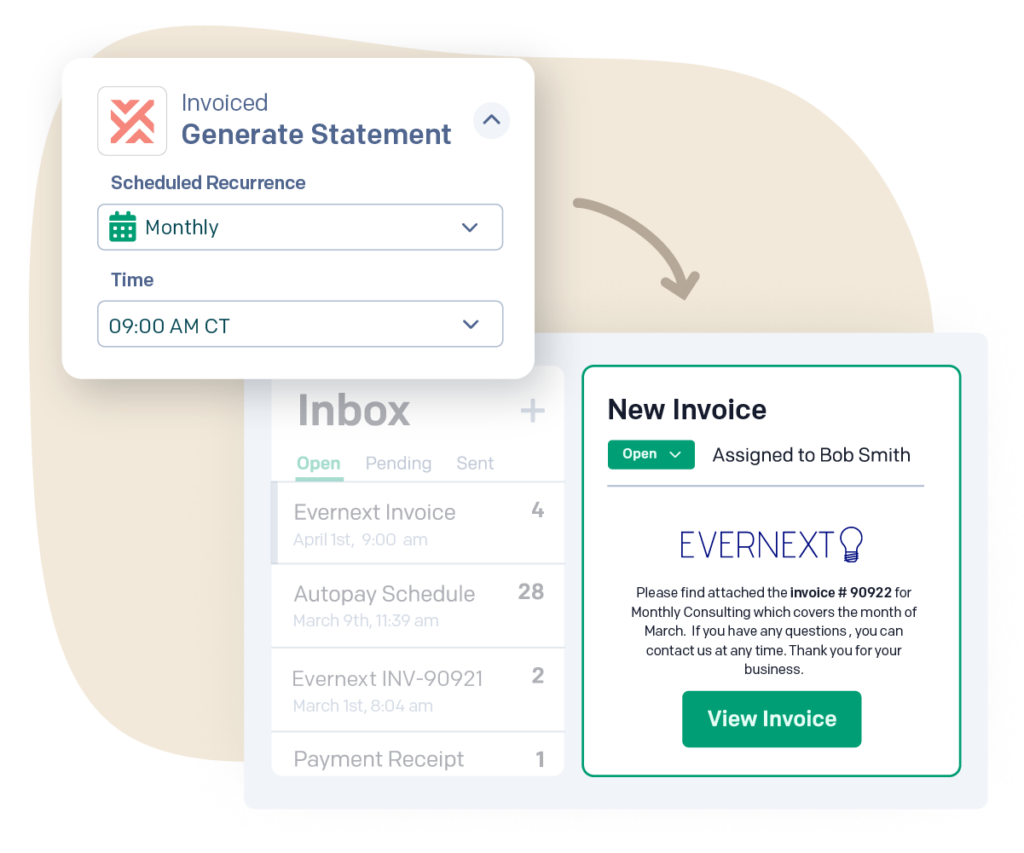

With Invoiced, you can easily set up automated invoicing tailored to your needs, no matter how complex your requirements are. Creating a new invoice is quick and intuitive — just indicate the appropriate items (such as products, hours, or shipping, etc.), select the date, add taxes and discounts as needed, and include any notes or attachments required. When your new invoice is complete, you can save it and issue it right away or hold it to send later when you’re ready.

Once your parameters are set, you can auto-generate all future invoices for your customer or account. You can also configure an automated chasing rule to send your invoices as soon as they’re generated, creating a seamless invoicing workflow.

These invoices can also be created in your accounting or ERP system and synced back to Invoiced.

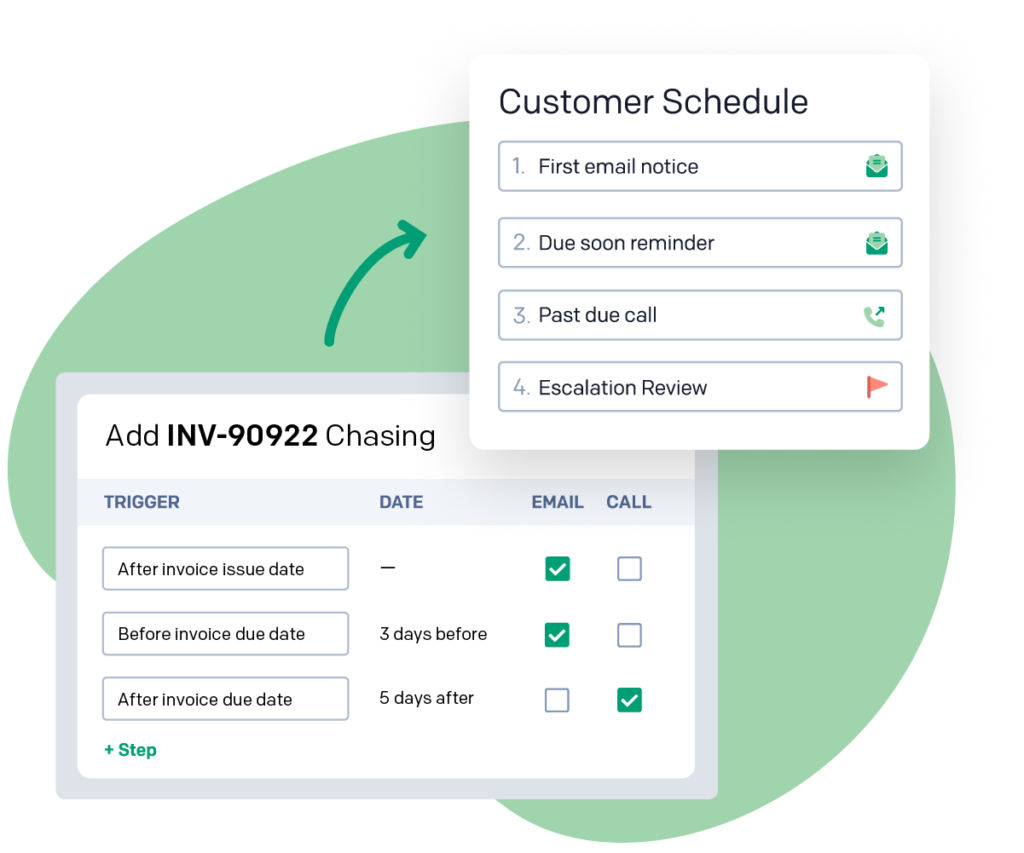

The Invoiced platform offers a sophisticated Smart Chasing feature designed to minimize the time and effort your team spends following up on overdue payments. Simply decide whether you want to set up chasing at the invoice or customer account levels (or both), choose your preferred channels (email, text, and/or postal mail), and create your desired communication schedule. Invoiced allows you to configure different frequencies, channels, and messaging for every account or invoice you enroll in Smart Chasing. After setup, Invoiced can automatically execute all of your Smart Chasing workflows.

Of course, you can still interact directly with your customers when an automated communication won’t do — our inbox allows you to send and receive customer emails without leaving the Invoiced environment. Our inbox stores your communications in a single central location, offering integrated workflow tools to manage conversations, set an account status (open, pending, or closed), add internal notes, and more.

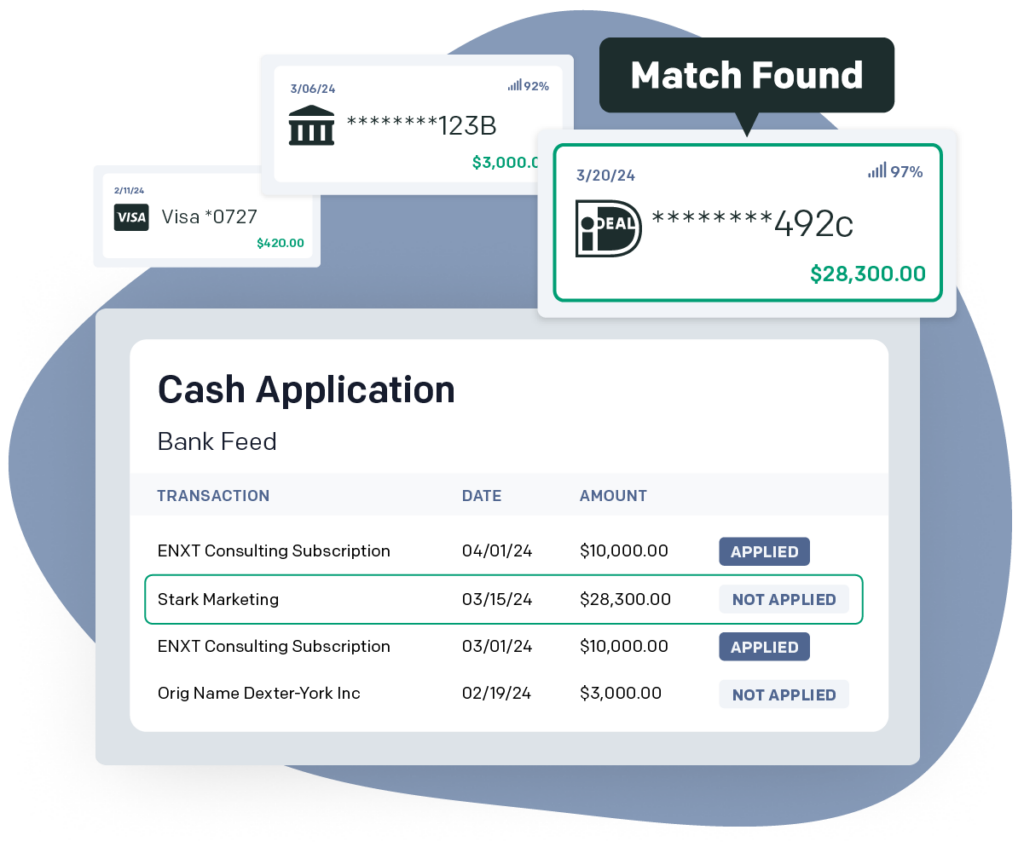

Cash application and A/R reconciliation — both processes that involve matching customer payments you receive against the amounts you’ve invoiced for — are time-consuming and labor-intensive for an accounting team to take on manually. But at the month’s end, far too many organizations still devote valuable time and resources to matching and clearing transactions, line by line.

With Invoiced, you can transform this arduous monthly task into a seamless automated workflow, allowing you to identify potential issues more quickly, eliminate human error from the process, and free your team to focus on other concerns. Plus, our automated workflows scale as your business grows — no matter how large your transaction volume becomes, you can count on Invoiced for fast, accurate A/R reconciliation and AI-powered cash application.

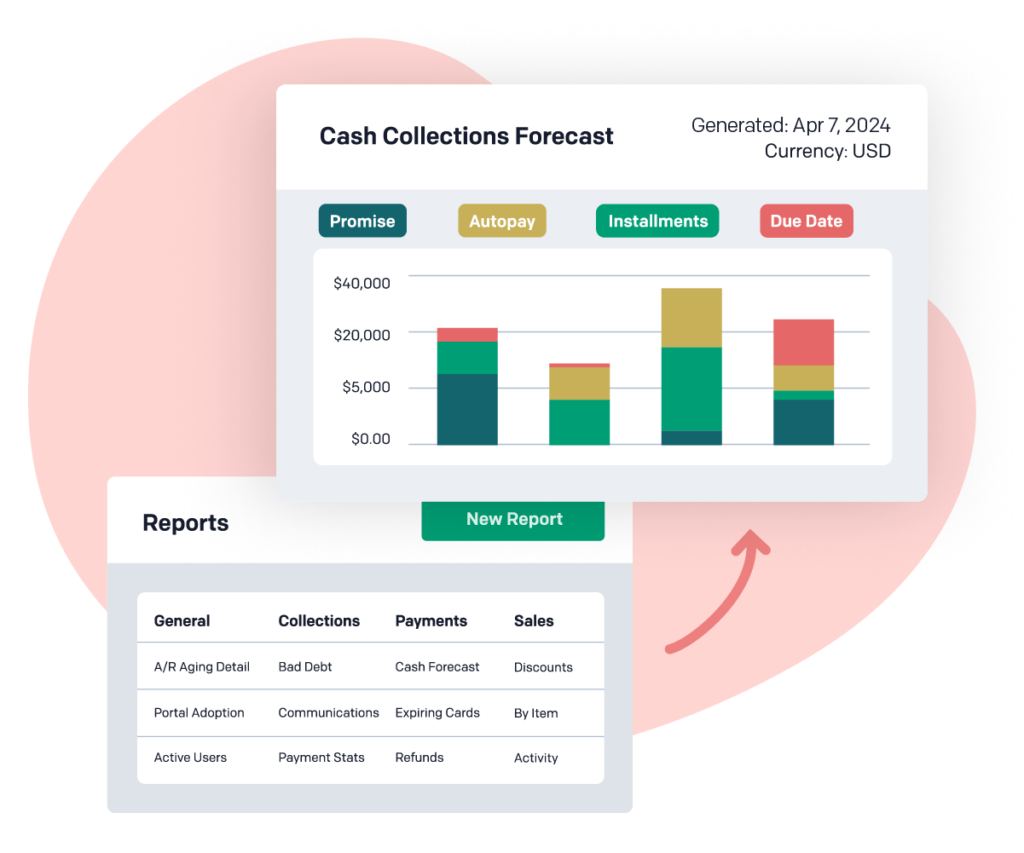

The Invoiced platform doesn’t just automate and accelerate your organization’s entire invoice-to-cash process; it also delivers the meaningful insights you need to make better-informed business decisions. Using data from invoices, autopay, payment plans, promises-to-pay, and customer payment history, Invoiced provides highly accurate forecasting to let you know when you’ll receive payments.

And Invoiced offers powerful reporting capabilities across your invoice-to-cash lifecycle. Find out what you need to know quickly by checking your analytics dashboard or viewing one of 30 out-of-the-box reports on collections, sales, payments, or overall A/R performance. If you want to answer questions not covered by standard reporting, creating your own with our Report Builder is quick and easy. Choose one of 40 data types, set your visualization format (table, chart, or metric), and select the fields you want your report to display.

Auto-generate invoices to your specifications using your pre-selected parameters for a customer or account, including payment terms, sales or service items, discounts, taxes, and late fee scheduling. These invoices can also be created in your accounting or ERP system and synced back to Invoiced.

Yes. Invoiced offers multiple default templates for invoices, but it’s easy to create your own custom template for branding purposes.

The Invoiced platform offers a flexible subscription billing feature to help you bill for recurring charges more efficiently. You can quickly and easily set up your plan, choosing whether you’ll auto-charge your customers each billing cycle or issue invoices for payment.

Yes, the Invoiced platform is designed for seamless integration with other accounting and ERP systems, including NetSuite, QuickBooks, Sage Intacct, and more. Connecting Invoiced and your ERP application can improve your process efficiency, reduce costs, and provide centralized data access to teams across your business.

Yes. With Invoiced, you can set up late fees to your specifications, including the grace period you allow, the amount you charge, and the cadence of the reminders you send. After you set the parameters, Invoiced automatically calculates and applies late fees to your invoices going forward.

Yes. Your customer can click the “View Invoice” button in your email to submit payment via the Invoiced customer portal.

Onboard and start accepting payments in minutes. Invoiced supports ACH, BACs, credit cards, iDeal, SEPA, and other alternative payment methods. You can invoice your customers in their preferred currencies and languages, ensuring a smooth billing experience no matter where they are.

Yes. With the Invoiced platform’s Smart Chasing feature, you can easily configure automated follow-up communications to your specifications. You select the terms, cadence, and communication channels—Invoiced takes care of the rest.

Yes, Invoiced provides real-time reporting based on payment data, including forecasting. That means you can spot trends across customer accounts, see how particular offers or payment plans are performing, and manage your A/R more effectively.

Yes. The Invoiced platform is designed to help organizations of all sizes get paid more quickly, efficiently, and securely. Offering scalable pricing plans, Invoiced is accessible for small businesses and cost-effective for large organizations. The platform’s customizable workflows are designed for integration with a wide array of applications—those used by SMBs and those used by large enterprises.