USE CASES

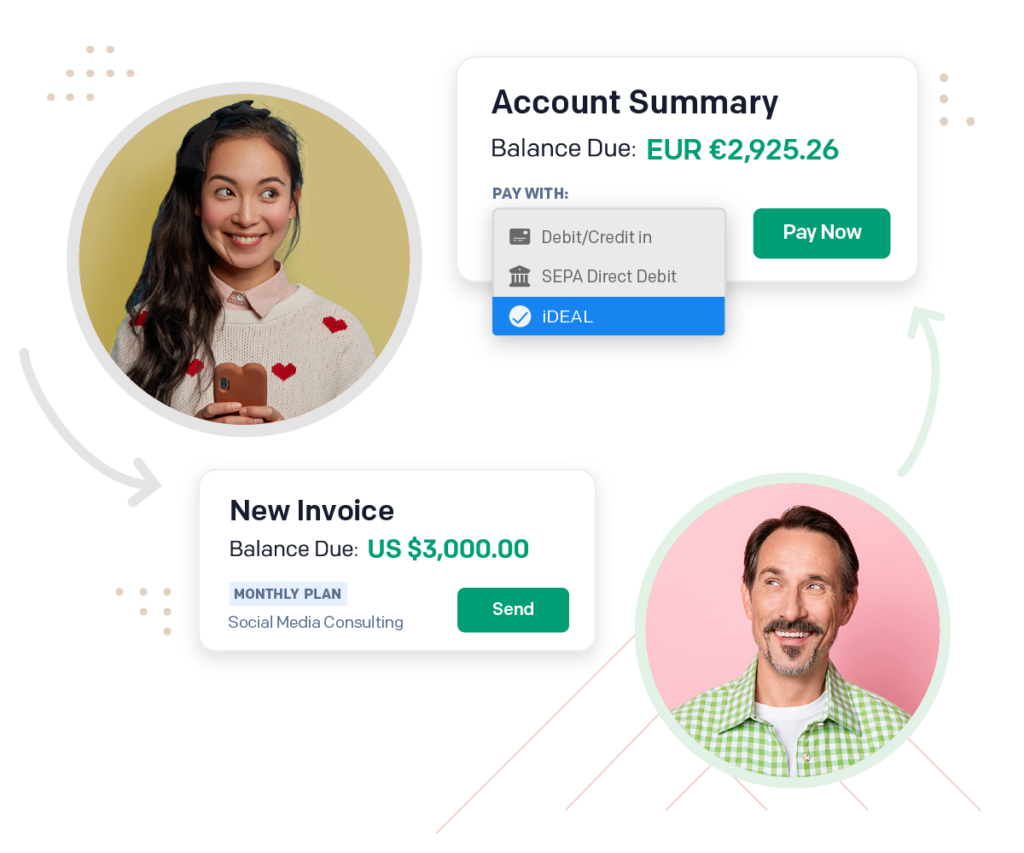

Cross-border transactions don’t have to be costly or time-consuming for your business. With global payments enabled through Invoiced, you can bill and receive payments from international clients without the usual fees, risks, and delays. Enjoy fast and convenient payments with support for over 1,200 local payment options – tailored to your business and customers’ needs.

Global payment management looks different with Invoiced. Bill your international clients in local currencies, mitigate your FX risk, and streamline reconciliation with global payment processing via your Invoiced environment.

Invoice your international clients and receive global payments without lengthy delays or excessive transaction fees. Enable global payment processing in your Invoiced environment for easy, seamless cross-border transactions.

Cross-border payments can be costly for companies operating internationally. Intermediary bank transfer charges, currency conversion fees, and foreign transaction fees can add up to a significant portion of the total transaction value. And FX payment rates fluctuate regularly, exposing businesses to the risk of an unfavorable shift in currency values.

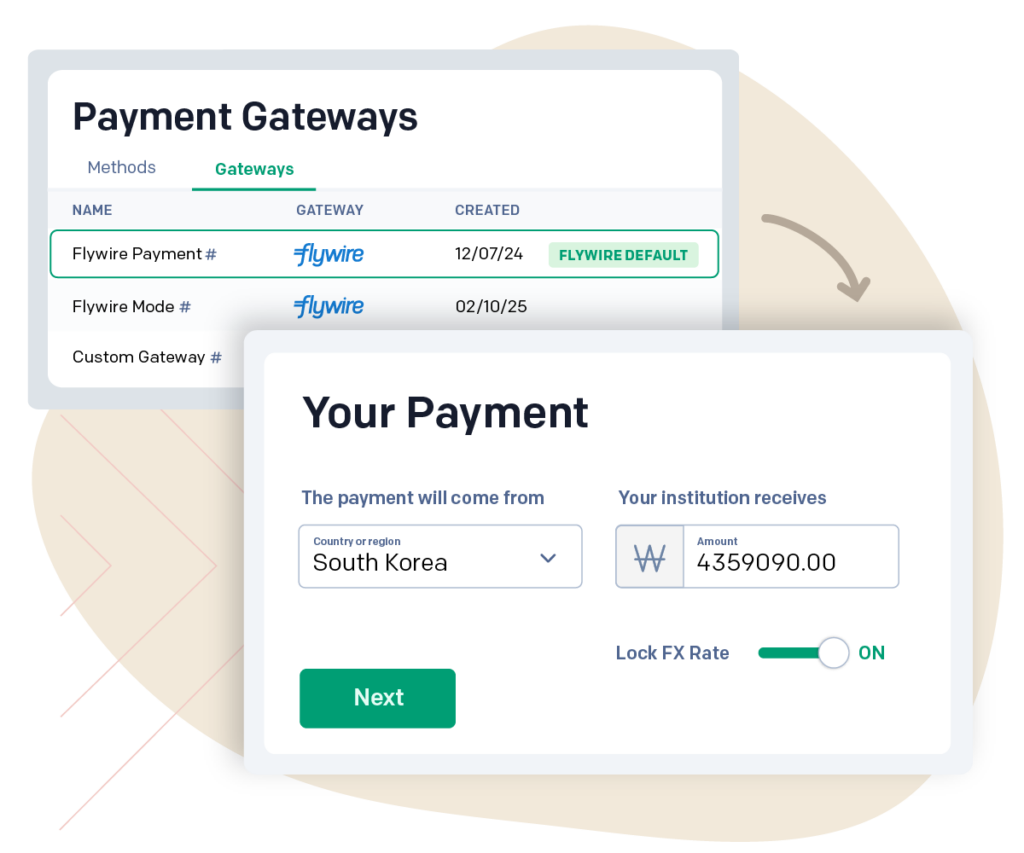

With payment processing via your Flywire Payments, the Invoiced platform taps into an extensive international payment network, bypassing the intermediary banking institutions traditionally involved in cross-border transactions and eliminating many standard fees. Sellers can set up their transactions at a fixed rate to lock in exchange rates when invoicing or rely on real-time rates favorable to both the seller at invoicing and the buyer at the time of the payment. Both options help mitigate risk and protect sales margins.

If your company still relies on manual processes to invoice international clients, you know how complicated it can be. You deal with different currencies, exchange rates, fees, taxes, and languages. And your cash flow suffers if you don’t bill your customers accurately and efficiently.

When you enable global payment processing in Invoiced, you can quickly and easily bill your customers in their local currencies—no manual calculations are required. You’ll free your organization from hours spent on international billing, eliminate human error from the workflow, and reduce DSO for your global invoicing.

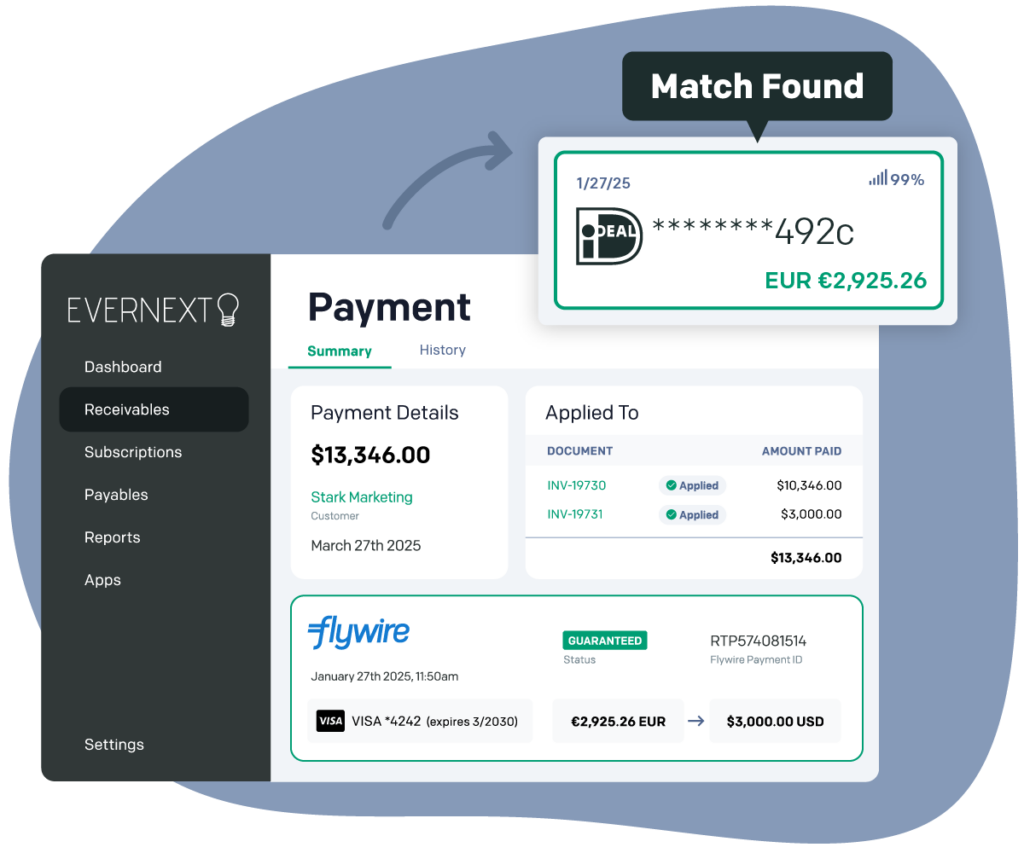

When doing business with a client in a different country, reconciling the payments you receive against your open invoices can be tedious and time-consuming. And if your company serves a sizeable international customer base, the issue is compounded. How can you perform A/R reconciliation efficiently for thousands of global transactions?

With global payment processing enabled, the Invoiced platform can apply its high-performance reconciliation and AI-powered cash application capabilities to your international billing and collections. Invoiced scales to rapidly and accurately apply customer payments to your open invoices, no matter how many global transactions your business processes.

For a globally expanding business, seamless and reliable workflows for international billing are paramount. However, the time and resources required to set up new banking infrastructure or manage foreign exchange risk may take a lot of work.

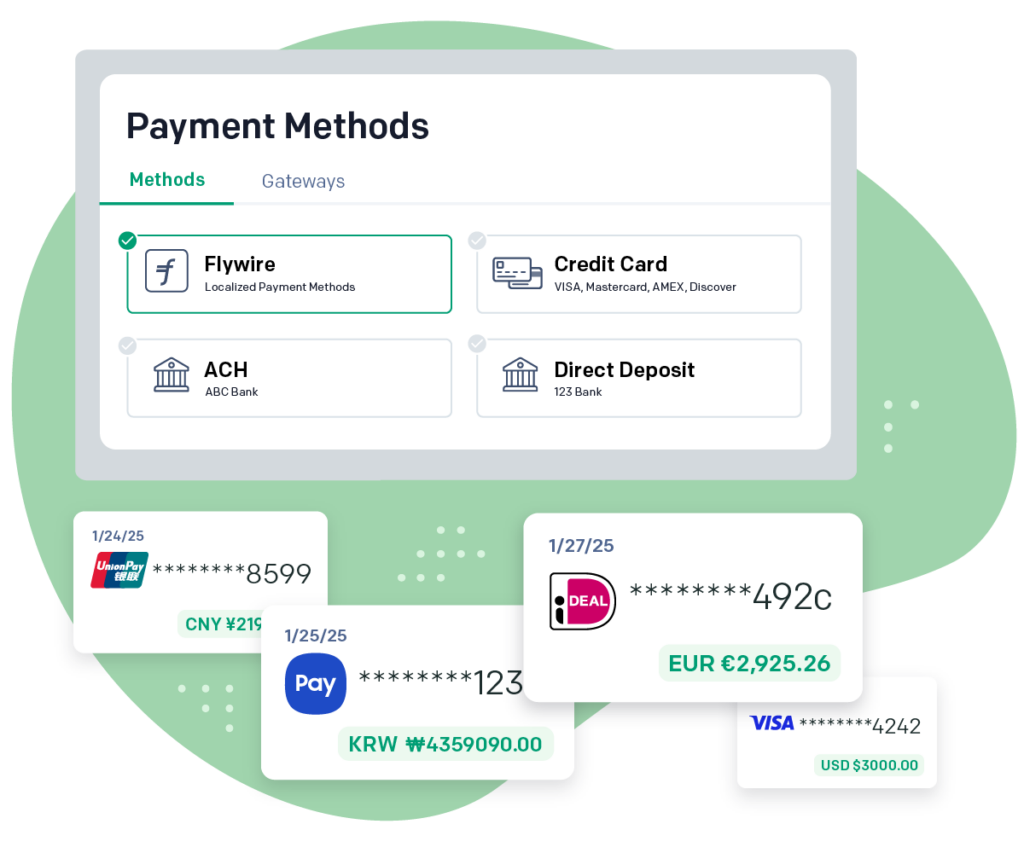

With Invoiced, you can expand into new markets without adding international banking accounts or tackling the complexities of cross-border transactions. When you enable global payment processing in the Invoiced environment, you can bill your international customers in their local currencies, accept a wide range of payment methods (credit card, wire transfer, and more), and protect your sales margins by locking in an FX rate.

Cross-border services allow businesses to bill and settle in different currencies. Conducting transactions across national borders can be time-consuming and costly, requiring organizations to enter data into multiple banking portals and pay transfer fees, currency conversion fees, and other expenses. With global payment processing enabled in the Invoiced environment, the platform taps into a global payment network that bypasses intermediaries for fast, easy transactions at a lower cost.

Invoiced allows users to pay invoices using their preferred localized payment method and in their own currencies when global payment processing is enabled. By passing the intermediary banks traditionally involved in cross-border transactions, the workflow eliminates many charges and minimizes foreign exchange fees.

Yes. When you enable global payment processing in your Invoiced environment, the global payment gateway you select handles your customers’ currency conversion and billing in their preferred currencies.

You have the option of setting fixed or real-time rates for cross-border transactions. This helps manage fluctuating rates with your clients at the time of billing, ensuring you receive payment at that same rate you invoiced them.

After you enable global payment processing, Invoiced matches incoming payments from international customers with your company’s open invoices. The global payments you select perform currency conversion, ensuring accuracy during the reconciliation process.

Global payment management features benefit organizations of all sizes that operate internationally and must conduct cross-border transactions seamlessly and securely, including advertising and marketing agencies, educational institutions, financial firms, healthcare organizations, insurance providers, and law firms.

Yes, the Invoiced platform is designed for seamless integration with other accounting and ERP systems, including NetSuite, QuickBooks, Sage Intacct, and more. Connecting Invoiced and your ERP application can improve your process efficiency, reduce costs, and provide centralized data access to teams across your business.

To learn more about setting up global payment processing with Invoiced, schedule a demo.

Yes. With global payment processing enabled in your Invoiced environment, you can set up automatic recurring invoices for clients outside your country and select local currencies for each customer based on location.