If you deal with high-value sales or engage in long-term service programs, specific potential customers might balk at your offerings’ equally sizable price tag. And while you can limit your clientele to only those organizations with high volumes of cash in hand, consider another option.

By offering payment plans for your credit-based sales — rather than requiring full payment all at once — you can attract a broader audience and offer buyers more flexibility when working with your company. In this article, we’ll analyze the potential of customer payment plans in more detail, including how they work, the value they offer, and whether one is right for your business.

What are payment plans or installment plans?

As the name would suggest, a payment plan or installment billing is an agreement made between two parties that covers the repayment of a debt. But rather than requiring a lump sum within x days of receiving an invoice, the owed amount is instead segmented into smaller installments made according to an established schedule.

In many ways, this strategy bears several similarities with a subscription billing model — particularly one that uses annual billing upfront. However, while a subscription routinely covers an ongoing service or product delivery with payment plans, the corresponding offering has typically been fully provided to the buyer.

How do payment plans work?

Before anything else, you must set the plan’s terms, including the total purchase price, payment schedule, and interest or fees. Subsequently, the buyer must agree to these terms at the time of purchase. Sometimes, you may require a downpayment to mitigate some of your risk.

Once the product or service and the corresponding invoice have been delivered, the buyer will begin making regular payments per the established schedule. You should put in place corresponding dunning efforts that align with these due dates to encourage consistent, prompt payment at all stages. Interest and additional fees may apply depending on how you structured the deal.

Finally, once all installments have been made, the process will conclude, and you’ll close out the invoice.

Why should a business accept partial payments?

In one word: flexibility. But if you’d like a more detailed explanation of how supplementing your payment terms with an installment-based approach might add value to your business, consider that these plans will empower you to:

- Attract customers: As previously mentioned, not every buyer is flush with cash. However, by offering payment plans, you can cater to a much larger market.

- Drive revenue: When you make it easier for customers to spend with your business — especially without large upfront costs — they’re likely to purchase more. This often results in either increased purchase frequency or higher order values.

- Strengthen customer relationships: Missed payments — particularly the penalties associated with them — can quickly sour a business relationship. That’s why many organizations will extend payment plans to customers struggling to pay off their debts, even if the company doesn’t typically offer this as a default payment option. With this approach, the buyer can avoid penalties and any damage to their credit history, encouraging increased loyalty going forward.

- Mitigate bad debt: Commonly, if a customer doesn’t have sufficient funds to pay off their invoice in full, they’ll hold off on paying the bill altogether. But you can discourage that inclination by breaking up that debt into more digestible bites — something they can pay with their limited cash.

- Stabilize cash flow: On a similar note, when dealing with large invoice values, a single missed or delayed payment can be rather disruptive to your overall cash flow. When these payments are being made more frequently at lower rates, however, one misstep will have a far smaller effect on your day-to-day financials.

Payment plan example

Climate Clairvoyant Enterprises (CCE) has perfected the art of weather forecasting. The company’s SkySeer 2000 is an AI-powered, sensor-filled prediction engine housed within a lifelike android frame that delivers on-air weather reports that contain 8.7% more corny jokes than their traditional human counterparts. And while significant networks could easily cover the hefty $1.2 million price tag for each SkySeer, smaller and more rural news agencies often lacked the cash to cover such a sizable purchase.

Wanting to open up its client base to include this previously untapped pool, CCE began offering buyers the option to set up a payment plan rather than committing to a lump sum due 30 days after invoicing. This move gained the interest of KRNR, a news radio coop that served the Four Corners region.

KRNR opted for the 37 plan, which broke up the cost of the SkySeer into 36 payments of $33,333.34 due each month for the next three years. KRNR would also make one additional payment — a 37th one — at the end of three years to cover the plan’s associated interest, finance, and tax costs. With the terms agreed upon and the SkySeer delivered, KRNR followed the plan, with CCE sending routine reminders around each installment due date.

How to create a payment plan with Invoiced

Of course, how you structure and manage the payment plans you offer to your customers will vary widely depending on client temperaments, your industry, your region, and all other factors. And while you’ll likely need to put a lot of research, time, and effort into finding the appropriate terms for these plans, delivering on them will be relatively easy — at least if you have the correct accounts receivable (A/R) solution in place.

Our Accounts Receivable Automation software can make executing payment plans a breeze for your billing teams. Assuming you’ve defined your conditions and agreed on terms with your customers, you simply will need to:

1. Create an invoice

For each purchase made with a payment plan, you must generate a new invoice for the sale using your software’s dashboard. Just fill in the customer, purchase, and pricing information usually.

2. Build a schedule

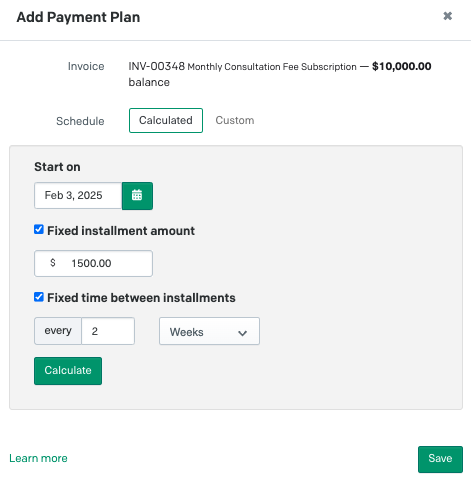

Within the billing dashboard, select Actions → Add Payment Plan, and a new dialog box will appear. You can use our calculator to create your routine payment plan once you’ve determined the desired installment amount, installment frequency, and time between payments.

For non-uniform plans — meaning that the payments or the times between them are not evenly distributed — you’ll want to switch the schedule option to Custom. You can manually enter the relevant pricing and due dates with this choice.

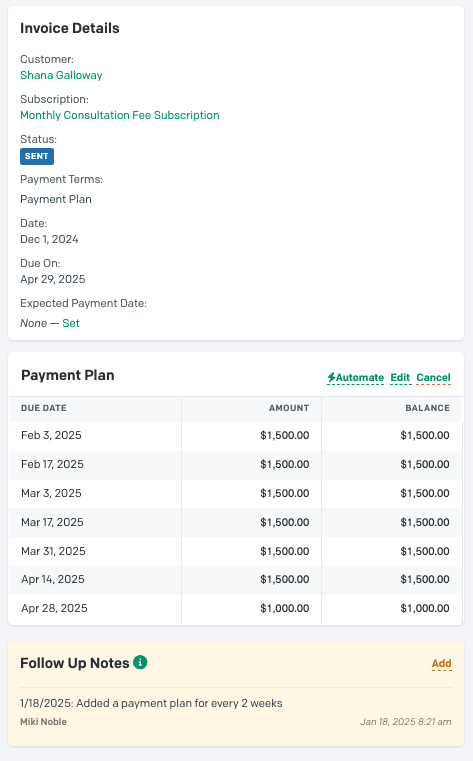

3. Save and send

Before saving the schedule, we recommend that you double-check your selections. Once saved, the schedule cannot be updated, so if there’s an issue, you’ll need to delete the erroneous schedule and create a new one.

Now that you’ve set up the payment plan, you will send the invoice to your customer for approval. And when they click Pay, they’ll see the payment plan instead of the standard payment screen.

Get paid faster with Invoiced

At this point, installment plans can be a helpful and valuable addition to your payment options. And no matter which payment methods you support, you’d be hard-pressed to find a more efficient, adaptable, and cost-effective solution to manage them than our Accounts Receivable Automation software.

Enhanced by Flywire’s global payment capabilities to support transactions in over 140 currencies, our solution lets you streamline your invoice workflows and accelerate your payment timelines. Our software can even automate your dunning efforts with our Smart Chasing feature, which will keep consistent, prompt payments at the forefront of your customer’s minds. We also offer an AutoPay capability that you can extend to buyers, further mitigating the risk of late or missed payments.

Want to learn more about what we can deliver? Check out our Payment Plans Guide for a deeper dive, or schedule a demo today.