You’re overlooking something. There’s a really important task that you should be doing right now, but you can’t quite recall what it is. Or maybe you’ve done it already? Either way, you’re confident that it’s something you shouldn’t forget, which is why you wrote yourself a reminder …but you may have also forgotten where you put that.

It’s a doubt that we’ve all felt at some point, and forgetting things — sometimes even important things — is just part of the human experience. But when the humans experiencing this doubt are your accounts receivables team, that can be a problem. And that’s why many businesses, rather than trusting in the resilience of human memory, have begun automating simple but often overlooked tasks — tasks like overdue invoice reminders.

What Is an Automated Invoice Reminder?

An automated invoice reminder solution is an application or tool that allows the user to set up recurring communications — requiring little to no human intervention — with customers to follow up on (or chase) outstanding and past-due invoices. These touches might occur through email, letters, text, messaging app, or even over the phone. And typically, these contacts are scheduled when an invoice becomes 30-, 60-, and 90-days overdue, increasing the urgency of their tone as time progresses.

How It Works

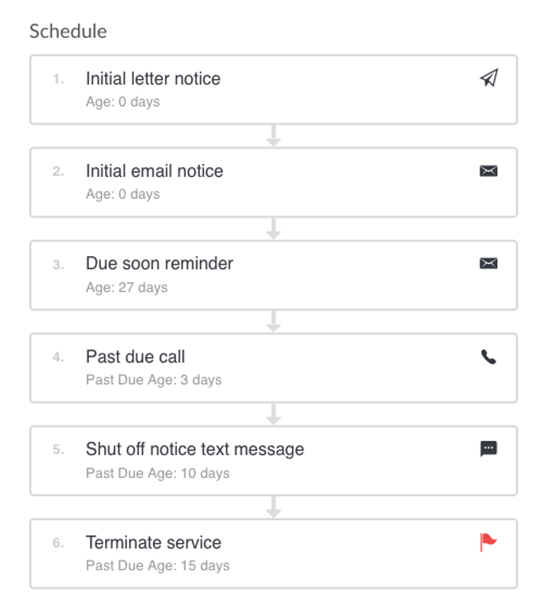

Increasingly, businesses are opting for A/R automation or collections software with built-in, automated chasing functionality. After choosing a tool, you’ll set up a cadence — or set of rules governing your outreach— for invoice-related communications. This cadence will dictate when and how a customer should be contacted (e.g., send a friendly SMS reminder message 3 days before the payment is due).

A typical cadence might look something like this:

Once the rules are established, an automated reminder platform will handle most of these touches independently as each scheduled date arrives. However, some tools might also notify your staff to take action through task assignments, such as prompting an account representative to call the client directly.

The Benefits of Automated Invoice Follow-ups

Manually chasing overdue invoices opens the door for human error and cumbersome manual processes to undermine the efficiency of your accounts receivable efforts. Offloading these repetitive and sometimes monotonous tasks delivers several advantages.

Productive Staff

The purpose of automation is to make processes run more smoothly with limited or no human intervention. So instead of your team spending time composing reminder texts or digging through spreadsheets and emails to determine which customers need to follow up with an automated invoice reminder, they free up time to focus on more productive or complex tasks.

Stronger Communication

For any given invoice cycle — particularly those that hit the 90-day mark and beyond — you might end up contacting your customer over a dozen times. Establishing a consistent message and setting customer expectations across multiple touch points without a formalized, repeatable process can prove difficult. But when these communications are templated and automated, you can be more confident that your notices are understood. Sending out automated, recurring notifications can help keep the lines of communication open and routinely leads to better business relationships.

Prompt Payments

When using digital channels like email and SMS, you can include direct links to your payment platform, giving customers the opportunity to handle any outstanding invoices immediately — before they have time to forget. Also, if your business offers multiple payment options, this method will subtly encourage invoice-holders to pay electronically, which will get you your money more quickly. Many companies report significant reductions in time to collect after implementing automated chasing.

Beyond Reminders

Of course, not all automated invoice reminders are the same. Some tools deliver only limited email functionality, while others offer omnichannel support. Ideally, you’ll want a system that delivers an intuitive interface that lets your accounts receivable team quickly and easily adjust communications to fit the specific needs of your business. And beyond just the messaging options, there are many other valuable features to consider.

Clear Analytics

If you’re going to streamline or improve the efficiency of your reminder processes, you need to know what works and what doesn’t. Ideally, your choice will offer reporting functions that let you track (among other things):

- What reminders have been sent in the past

- Which steps/contact methods resulted in payment

- How many touches are required on average

- What percentage of invoices are outstanding

And armed with this insight, you can refine your current practices and easily test out new strategies.

Flexible Templates

Providing your customers with an effective reminder email can mean the difference between a prompt payment or sending the account to collections. These notices — at least initially — should create a sense of urgency while remaining cordial. They need to stay concise, clearly outline expectations, and define any potential ramifications, like late fees.

Fortunately, these types of notices tend to be standard across accounts, so your business can easily create customizable templates for your 30-, 60-, and 90-day reminders. And if you’d like to review some standard email drafts that you can adapt to meet your unique company needs, check out our recent blog: How to Write a Past Due Invoice Email (And Send Less of Them).

Consolidated Follow-Up

More than likely, several of your customers have made multiple purchases from you, meaning that they each potentially hold multiple outstanding invoices. To cut down on any possible confusion, find a reminder platform that will allow you to chase overdue invoices at the account level. When customers have a thorough understanding of what they still owe, they are better equipped to make prompt, accurate payments.

Chase Smarter, Not Harder with Invoiced

If you’d like to see how easy you can make your invoice reminder processes, consider scheduling a demo of our A/R Collections software. With our Smart Chasing Engine, you can let the software keep your customers apprised of outstanding bills while you focus your accounts staff on more strategic tasks.