Financial controllers have come a long way. No longer focused exclusively on crunching numbers to keep day-to-day operations moving, these critical financial leaders now serve a more strategic purpose, often driving data analysis and strategic planning efforts in coordination with key decision-makers across the business. However, these expanded responsibilities come at a cost, forcing financial controllers to split their focus across short-term operational management and long-term maneuvering.

Process and technology inefficiencies that could have been previously overlooked or ignored now have a broader impact and must be addressed more aggressively. Automation can help resolve these challenges while making capturing, collating, and digesting critical financial data easier. In this article, we explore the predominant difficulties that financial controllers face and how automation — particularly automation focused on improving accounts receivable (A/R) processes — can help overcome these obstacles.

What is the role of a controller?

Often a senior-level manager within the accounting department, a financial controller oversees all of the day-to-day financial activities — accounts receivable, accounts payable (A/P), general ledger, inventory accounting, etc. — for a given organization. You’re more likely to find the role in medium- and large-sized businesses, as smaller companies tend to assign these tasks to their chief financial officers (CFOs).

Of course, the actual duties will vary depending on the nature and size of the business as well as the industry and other factors. Still, commonly, financial controllers are responsible for the following:

- Establishing corporate accounting policies and processes

- Managing the finance department

- Driving cost-saving initiatives

- Advising company managers and stakeholders

- Creating budgets

- Approving invoices

- Balancing cash flow

- Processing payroll

- Ensuring compliance with financial regulations and industry standards

- Developing strategies related to risk management and opportunity forecasting

- Preparing and publishing financial statements

- Overseeing tax filings

Top challenges financial controllers face

With so many areas of responsibility, controllers face various challenges, ranging from personnel management to rule enforcement to data analytics. While there are far too many to cover in a single article, we’d like to address some of the more common—and readily addressable—issues.

Stale data

Accurate reporting can take time. But you don’t have time to wait if you’re trying to deliver these details quickly to support in-the-moment operational decisions or any strategic choice with a hard deadline. Even worse, if the raw data you’re looking at is outdated or includes inaccuracies, you’re much more likely to make an inefficient — or even wrong — choice for your business.

Further complicating matters for financial controllers, these reports often must be shared with stakeholders outside the finance department. This means that they must contain the relevant data and the underlying context that rationalizes what the information truly means.

Budget deviations

Forecasting future events inherently involves uncertainty and risk, as it is impossible to predict outcomes accurately. Many planning decisions are driven by operational inertia or intuition, frequently leading to overly conservative estimates or missed targets.

However, by leveraging real-world data in these forecasting efforts, you can often make smarter, more nuanced choices, particularly regarding accounts receivable management. Converting a historical record into a plan for the future is easier said than done.

Fraud, theft, and other shenanigans

Among the incidents of fraud evaluated by the Association of Certified Fraud Examiners (ACFE) in its Occupational Fraud 2024: A Report to the Nations, asset misappropriation schemes were the most common, accounting for 89% of all cases. Within this category, billing schemes alone represented 22% of these attempts. Moreover, payment tampering and billing fraud were the misappropriation schemes that resulted in the highest median losses, costing victims an average of $155,000 and $100,000, respectively.

If your business handles money, there are unscrupulous people out there who seek to exploit it. Many of these vulnerabilities fall within the purview of the financial controller.

Errors

In business, accuracy matters. Any time your accounting staff needs to manipulate or transcribe data manually, the potential for human-based errors to occur increases dramatically. Even worse, when the wrong unit number ends up on an invoice or a buyer’s payment information is incorrectly transcribed, you’ll often spend more than twice as much labor identifying and correcting the fault than had you entered it correctly the first time.

If these errors persist — particularly if your billing or shipping totals are consistently inaccurate — the impact on your business could be devastating.

Anemic cash flow

The longer it takes to provide your customers with an accurate invoice, the longer — and less likely — it will be for you to receive payment. Slow, inconsistent income yields a much less predictable cash flow cycle, frustrating planning efforts and limiting your ability to respond promptly to opportunities or market trends.

How AR automation can help financial controllers

Fortunately, for each of the challenges mentioned above, a ready-made solution is already available — AR automation. In particular, we believe that automating A/R processes specifically can empower financial controllers to take greater control over their data while accelerating processes and being better positioned to adapt to future business and financial demands.

Of course, not all automation solutions deliver the same capabilities and features, so you’ll want to focus on more robust platforms that can readily fit into a broader financial ecosystem — like our Accounts Receivable Automation software. With that in mind, here are a few ways automation software can solve the most common issues financial controllers face.

Accurate, customizable financial reporting

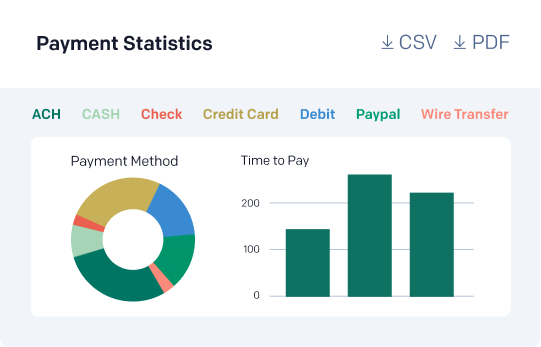

Most automation platforms offer some form of integrated reporting capabilities that can help you, your stakeholders, and investors understand your financials. Invoiced’s A/R solution boasts several pre-built reports that gather real-time data and can deliver high-level summaries alongside granular insight on A/R performance, collections, payments, and sales at an enterprise and business unit level.

At the same time, our Advanced Reporting add-on allows you to create customized reports and dashboards that can be built with hundreds of object and field types. You can even write custom queries to dig deeper into your performance data.

Even better, with more accurate financial and operational data at your fingertips, you can streamline your compliance efforts while being more confident that what’s in the report is actually what is happening within the business.

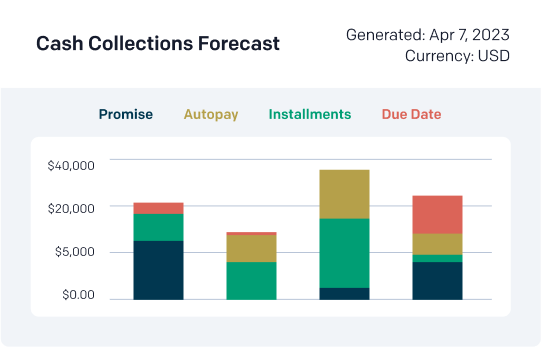

Data-based forecasting

With a steady stream of accurate reports, financial controllers and other key decision-makers can more readily track historical performance, making it easier to isolate and identify trends, particularly those that rely on multiple factors. While not all patterns repeat, basing decisions on how markets, your business, and your finances behaved under similar conditions will allow you to make more informed choices when budgeting or planning for the future.

To extract more value from this historical data, you might also consider investing in dedicated analytics software or taking advantage of your accounting automation solution’s planning tools. The Invoiced platform, for example, can generate high-accuracy forecasts regarding payment timelines, letting you better predict when you’ll receive your money and your overall cash flow.

Financial security

Our Accounts Receivable Automation software delivers automated workflows that not only remove much of the busy work associated with preparing, managing, and collecting invoices but also minimize the number of touches required to move a purchase through the procure-to-pay pipeline. The fewer hands a payment passes through, the less chance there is for it to end up in someone else’s pocket—metaphorically speaking.

With our software, you can limit who has access to your financials with comprehensive permission controls. Audit trails will yield insight into everyone involved with — and any approvals related to — a given invoice or payment. Ultimately, this transparency will be one of the most critical tools available to mitigate fraud schemes in your business.

Reduced errors with technical precision

Automated processes rely on extensive integration between corresponding systems, yielding more accurate invoices and payment records. For example, our platform can accommodate various third-party software, including multiple accounting, enterprise resource planning (ERP), and sales management platforms. So, rather than rekey data across these applications, you can pull current, accurate information directly from the source.

Similarly, we also offer access to an application programming interface (API) for the Invoiced platform to help you align your existing operations with our tool. Easily set up functions within your business systems or website that simplify control of your invoicing, payment management, subscription billing, metered billing, pricing, estimate creation processes, and more.

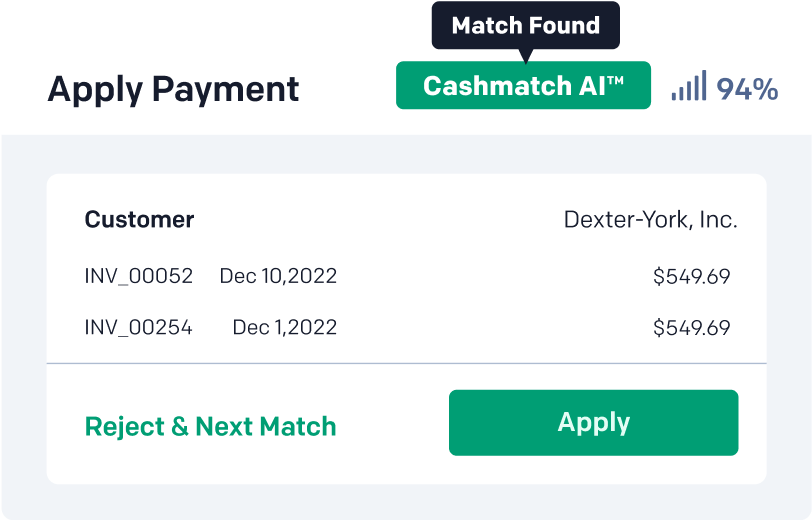

Beyond integration, we leverage the power of AI to help ensure that incoming payments show up in the right account and are credited to the correct buyer. Specifically, our proprietary CashMatch AI algorithm can automatically identify and apply remittance advice to all manner of complex payment situations, such as short payments, overpayments, or advanced payments.

Accelerated payments

The centralized process workflows we deliver with our Accounts Receivable Automation software help eliminate any procedural delays that might occur throughout the review and approval process, handling much of the validation and routing independently.

Not only can we accelerate the process of getting an invoice in the hands of your customers, but our Smart Chasing feature — which automates dunning efforts across email, phone, text, and other channels — will keep the need for payment at the top of their minds. Our A/R software can also readily accommodate early payment discounts and customized credit terms if you wish to incentivize faster further, more consistent payments.

We also deliver a self-service payment portal that lets customers manage when and how they transfer their funds. Portal users can schedule future transactions, update payment information, verify invoices, raise disputes, and download receipts from a single interface. Even better, Auto Pay functions eliminate the need for your customers to remember to pay off their invoices. It just gets done.

Invoiced: Automation that meets the A/R challenges of today and tomorrow

Automation can only solve a subset of the broad challenges facing today’s financial controllers.

However, the right strategy, combined with the right technology, can yield quick process gains and establish real-time data feeds that enhance the success of your planning efforts. To further explore how A/R automation can help relieve many of your headaches, check out our Financial Controller page.

Admittedly, you can find other tools that deliver some of the capabilities and advantages that we outlined. Still, our proven Accounts Receivable Automation solution can achieve all these benefits and more. Schedule a demo today to see how effective your short- and long-term financial operations can be.