From music streaming to grocery deliveries — subscription-based billing has become a fundamental part of how businesses operate today. In fact, according to research compiled by the Subscribed Institute, companies in its Subscription Economy Index have experienced growth 3.4 times faster over the past 12 years than those in the S&P 500.

While the overall market growth has moderated recently, the subscription economy within the software as a service (SaaS) sector remains robust, boasting a 20.1% compound annual growth rate (CAGR) in the six years leading up to 2023. These numbers underscore the ongoing appeal and effectiveness of the subscription-based billing model. In this article, we’ll explore what subscription billing is, different types of subscription billing, how subscription billing works, its benefits, and what to look for in subscription billing software.

What is subscription billing?

Subscription billing is a payment model that continually bills the customer at set intervals until the subscription is canceled rather than aligning charges with specific projects or deliveries. This method is typically used to charge for an ongoing service or continued access to equipment or technology. However, a subscription also covers a product’s regular, pre-approved delivery.

Subscription billing key terms to know

Before exploring subscription billing, it’s important to familiarize yourself with a few key terms that are frequently used in this billing model. Understanding these concepts will help you navigate the nuances of subscription management and make informed decisions for your business.

- Billing cycle: The set interval between the creation of invoices or the assessment of pre-authorized charges.

- Deferred revenue: An accounting term for payments received before service or product delivery, applicable for those subscriptions that have the buyer render payment at the beginning of the billing cycle.

- Recurring payments: While often used interchangeably with “subscription billing,” this model broadly refers to any pre-authorized payment schedule, including non-subscription charges such as timed installments for a larger purchase.

- Revenue recognition: The ongoing accounting process that documents revenue as it is earned throughout the subscription billing cycle.

- Subscription management: The process — and associated monitoring — of adding, removing, upgrading, and downgrading subscription services for a customer or group of customers.

- Subscription plans: Are the terms and conditions of a given service that outline pricing and delivery. Many companies offer more than one subscription plan depending on the nature of their business and their customers’ needs.

Types of subscription billing models

Fixed model

Also known as standard pricing, this approach involves consistent charges and payment cycles throughout the subscription’s duration. The only variation typically occurs if the rate increases permanently.

Usage-based model

In this model, the invoiced price varies based on the product or service the subscriber consumes during the billing period. This is ideal for services where usage can fluctuate significantly.

Hybrid model

This option combines elements of the fixed and usage-based models. It sets a flat base fee for the subscription, which increases if usage exceeds a predetermined threshold.

Freemium model

This method, commonly employed by independent software vendors (ISVs), is essentially a derivative of the hybrid model. As such, the base price for the service or software is free, and payment is only required if the user unlocks a particular feature or function.

How does subscription billing work?

From the perspective of the end-user or subscriber, the subscription billing lifecycle typically follows this pattern:

- Signup: The customer activates the subscription, either agreeing to be invoiced at regular intervals or providing their payment information up-front and pre-authorizing charges.

- Consumption: The subscriber has ongoing access to the desired service, technology, or products. At the same time, the seller receives regular payments for the subscription.

- Cancellation: When the customer no longer wishes to receive the benefits of their subscription, they can terminate the service, although the subscription agreement may influence the timing of when the cancellation takes full effect.

Subscription billing examples

To better understand how subscription billing works in practice, let’s explore a few examples that illustrate different models in action:

- Fixed: Up in the Sky Co. caters to the needs of flight-based superheroes, offering access to its network of high-speed wind tunnels at a flat, monthly rate. Subscribers can access one of their secure, conveniently located sites at any time to vet the aerodynamics of new costume designs, try combat techniques, or simply practice with their newfound powers in a private locale.

- Usage-based: Tasty Treats is best known for its Cookies for Colleagues service. Customers can install a CfC device in their office kitchen or break room, allowing employees to 3D print the baked goods of their choice as a reward from management for exceptional performance. Rather than charging a set rate for the service, Tasty Treats works under a usage-based subscription model, requiring the subscribing businesses to pay per cookie every month.

- Hybrid: Pigeon Patrol is a cleaning service specializing in removing avian waste from the exteriors of office buildings in the Detroit metro area. Under the standard subscription, customers receive a two-hour spray and scrub every week. However, if the cleanup for a given site takes longer than 120 minutes, the service charges additional charges at 15-minute intervals.

- Freemium: The Fang Finder app from Daywalker Inc. is one of the premier vampire tracking tools. While the app offers free sign-up and access to its community portal and newsfeeds, users must activate its real-time geo-tagging data regarding local graveyard disturbances, increased coffin sales, and other potential vampiric activity for a $6.95 monthly charge to view those features.

Benefits of subscription billing for businesses

1. Stabilized revenue

From an accounts receivable (A/R) perspective, how quickly your customers pay off their invoices will likely directly impact your overall cash flow. Under a subscription model, these payments are frequently pre-authorized or collected before delivery, reducing the procure-to-pay cycle.

In addition, depending on how your subscriptions are structured—for example, having a one-year service term—you can often more easily predict the number of subscribers and the revenue you’ll have at any given time.

2. Improved customer insight

Subscription models can serve as a valuable information-gathering tool regarding your existing customers and the market as a whole. These ongoing, repeated business interactions provide precise, historical data on customer behavior, preferences, and usage. This data can be leveraged to tailor your products and services better to meet consumer needs. Conversely, you can also review cancellation or downgrade trends to isolate plans or offerings that could be adjusted.

3. Reduced churn

Returning to the previously mentioned Subscribed Institute study, while the rate of overall subscriber acquisition has slowed in recent years, businesses within the SEI have consistently experienced better customer retention than comparable organizations outside the index. With steady, predictable billing, customers can easily anticipate expenses, simplifying their planning and budgeting efforts.

By establishing ongoing, hopefully long-term relationships with your clients, you can more easily build a sense of loyalty and community with these subscribers.

4. Recovered time

Typically, subscription billing practices require less labor and oversight than more traditional schemes, particularly in areas related to A/R. Rather than demanding excessive amounts of time for invoice tracking and dunning, most subscription plans rely on automated subscription billing software, freeing up staff for more strategic or customer-focused efforts.

What to look for in a subscription billing software

While a subscription model can help streamline processes for both you and your customers, managing and billing these plans can introduce nuances and complications that may increase the workload of your accounting staff. This is why many businesses turn to subscription billing software to manage these efforts efficiently.

These solutions simplify and accelerate your billing efforts and often enable you to derive even greater value from the general benefits delivered by this strategy. As such, when considering a platform, you should look for one that supports:

Automation

We believe automating your subscription billing efforts will yield the fastest return on investment for your software purchase. Ideally, the solution you choose will deliver centralized workflows that can consolidate and accelerate your invoicing efforts, removing unnecessary process delays. By automating routine steps in your billing cycle, you free up resources that can be reinvested elsewhere in your business.

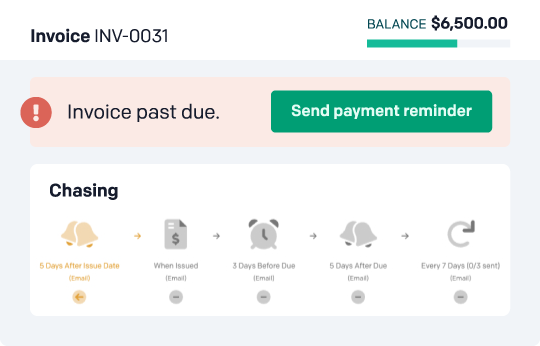

Invoiced’s Accounts Receivable Automation software offers AutoPay capabilities that remove the delays commonly required for payment authorization. Our Smart Chasing feature will standardize your dunning efforts while minimizing the need for direct human intervention.

Self-service

When you give your subscribers more control, they often experience increased satisfaction and overall brand loyalty. Therefore, consider solutions that empower customers to monitor and manage their subscriptions.

Our platform, for example, provides a customer portal where users can upgrade, downgrade, or even cancel their service independently. It also empowers them to monitor delivery details, review invoices, update billing information, and submit payments — all from a single interface.

Integration

Moving data between your customer, sales, and billing systems can be a headache. Manual processes for capturing and transmitting this critical business data can introduce unnecessary errors, delaying and disrupting your collection efforts.

However, when a platform offers comprehensive integration capabilities, you can remain confident that the data in your enterprise resource planning (ERP) systems will be the same data used to oversee subscription management and billing. Some solutions, like Invoiced, also provide application programming interface (API) support that empowers you to control invoicing efforts from within your existing software investments.

Analytics

Without hard numbers, it can be difficult to determine if your subscription plans are successful, so you should seek out a platform that makes it simple to collect and assess relevant subscription metrics. By monitoring these key performance indicators (KPIs), you can readily identify what is and isn’t working and take appropriate steps.

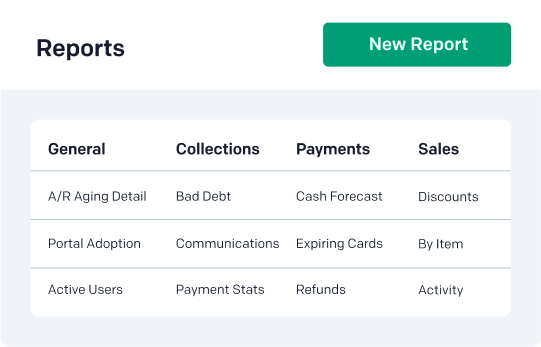

For example, our software delivers comprehensive pre-built reports alongside customizable templates that you can readily surface through centralized dashboards to keep your staff, investors, and other stakeholders well-informed.

Anti-fraud measures

Protecting your accounts from unauthorized access is crucial. So, you’ll want a subscription billing platform that includes robust anti-fraud measures. With Invoiced’s solution, you can utilize role-based access, limiting who can set up receiving accounts, authorize fund transfers, or view private customer data based on their user profile.

Invoiced: Get started with subscription billing without the fees

Invoiced Accounts Receivable Automation software is designed with a Subscription Billing feature that can seamlessly integrate with your plans and payment models, no matter how complex. With Invoiced’s subscription billing, you can automate customer charges each billing cycle or issue invoices that can be paid using the payment methods accepted on the account — with zero transaction fees. As an award-winning platform for the easiest setup and admin, you can get up and running immediately.

Schedule a demo today to explore how subscription services can transform your business, customer relationships, and invoicing processes.