- What is an Invoice?

- Invoicing Definition and Purpose

- What’s in an Invoice?

- How do I create an invoice?

- Online invoicing services make invoices even easier

- Final thoughts on invoicing

What is an Invoice?

Whether you’re a freelancer or a small business, most of you have wondered what is an invoice? In this post we go over exactly the invoice definition and other aspect of invoicing

The invoice is a critical element of your success. Without an effective invoicing method, your odds of getting paid on time are much lower than they should be.

Getting paid, and getting paid fast, is the backbone of any successful business, but invoicing is not always as straightforward or easy as it could be. We’ll break down the purpose, key elements, and various ways of invoicing for your business so you can master this important tool and get on with your success

Invoice Definition and Purpose

In short, an invoice is a bill — a document you send when someone owes you payment. It’s what you send to a client or customer when there’s a balance due for items you’ve sold or services you’ve rendered. The formal (but clear and helpful) invoice meaning according to the Merriam-Webster Collegiate Dictionary, is “an itemized list of goods shipped usually specifying the price and the terms of sale.”

In this definition, “goods shipped” can include digital products “shipped” via email, and it also refers to services rendered. In other words, it’s a record of what was sold and what is owed.

Invoices serve important purposes for both the sender and the recipient. For the sender, they’re a way to expedite payment by notifying the buyer of a balance due. For the recipient, they reflect costs in an organized, itemized way. They’re also important for record-keeping, on both sides of business.

For sellers, invoices provide documentation of outgoing inventory, outstanding bills, and (once paid) business income and taxes collected. For the buyer, invoices provide a breakdown of business expenses, taxes paid, and vendor contact information.

What’s in an invoice?

The purpose of an invoice is to offer details of exactly what has been purchased and how the payment can be made. There are several key parts to any invoice, often divided into header, body, and footer sections. The most effective invoices include the following elements, organized by section.

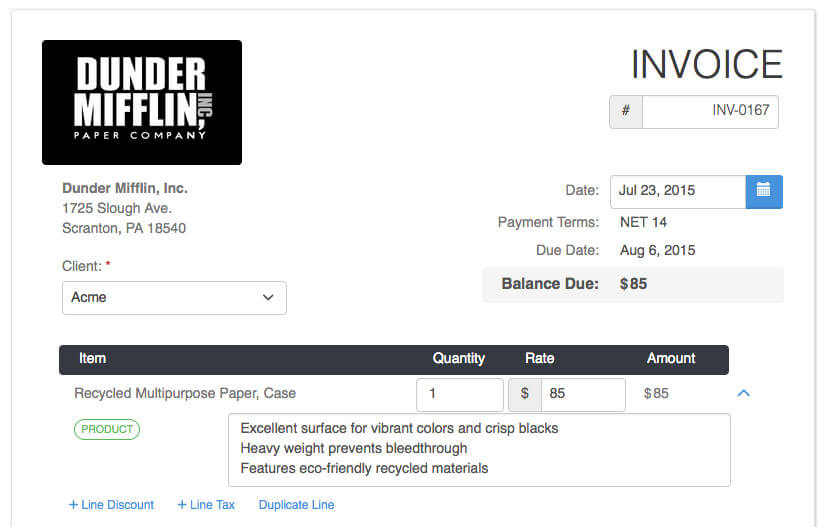

The header contains identifying information including the seller and customer contact information and specific information about the invoice itself.

Invoice number. This is an individual number assigned by the seller to distinguish this invoice from all others the seller sends. It’s usually present toward the top of the page, in the top (header) section.

Invoice date. Include the date the invoice is generated and sent on the invoice.

Payment Terms. When a payment is expected. This blog post covers payment terms in depth.

Billing company information. The name of the business and the contact person should be included in the header, with contact information. This is sometimes accomplished by incorporating the business letterhead into the design. In some circumstances (such as if the invoice includes collecting sales tax), the business’s tax ID also needs to be included.

Customer or client information. Likewise, the person or business receiving the invoice should be identified, with their contact information, in the header.

The body of the invoice contains the relevant information about the goods or services that have been purchased. This is where everything purchased is listed in detail.

Line items. The bulk of the body section is made up by line items. Line items name or describe the goods sold or services rendered, the cost per unit or hourly rate, the number of units bought or hours billed, and the total due for that particular item. An invoice can contain as many line items as is applicable — individual goods or services don’t require separate invoices, as long as they appear on separate lines.

Billable expenses. If you’ve had to pay for some things that the customer needs to cover, include these expenses on the invoice.

Total charges. A summary of all charges associated with the items or services being billed appears below the line items, though sometimes it’s at the top of the in the footer section instead.

The footer of an invoice usually sums up the total amount due by detailing any non-item charges, and it frequently includes payment terms, special instructions, and/or any additional comments.

Taxes or other costs due, if applicable. Sales tax, shipping charges, and any other cost being applied to the invoice are listed immediately below the total charges.

Total due. The total due is the full amount owed by the customer, including applicable sales tax and any other charges. The total due usually appears immediately below the total charges and other charges, and may also appear at the top of the invoice for reference.

Payment instructions. Payment instructions appear in the footer of the invoice, if they’re necessary. They might include a line about where to send checks, what credit cards are accepted, any early payment discounts, or applicable late fees if the payment isn’t received by the due date.

Additional notes or comments. In some circumstances, it makes sense to include date and mode of shipment or delivery. Some business owners may also include a special note to the customer on the invoice.

How do I create an invoice?

Invoices are a standard part of doing business, but there’s no single standardized form to use for invoicing. Add in the fact that so much of business invoicing and payments are conducted online, and there are countless methods of building and sending invoices. Traditionally invoices are sent through the regular mail, and that’s certainly an option many businesses use today. Others will create and send invoices electronically via email.

Some companies opt to design and send their own invoices. Many who do this will use spreadsheets, word processors printed on company letterhead, or custom invoicing software packages to create their invoices. There are also electronic templates available online that can be downloaded and then customized for each transaction.

Packs of pre-printed invoice templates can also be purchased at office supply stores and then written or typed individually as invoices are sent. These “manual” invoices can then be sent electronically or by mail and usually must be tracked by hand for accounting purposes.

More robust financial software may include an invoicing template, which can make keeping track of outstanding invoices and incoming payments much more straightforward.

Online invoicing services make invoices even easier

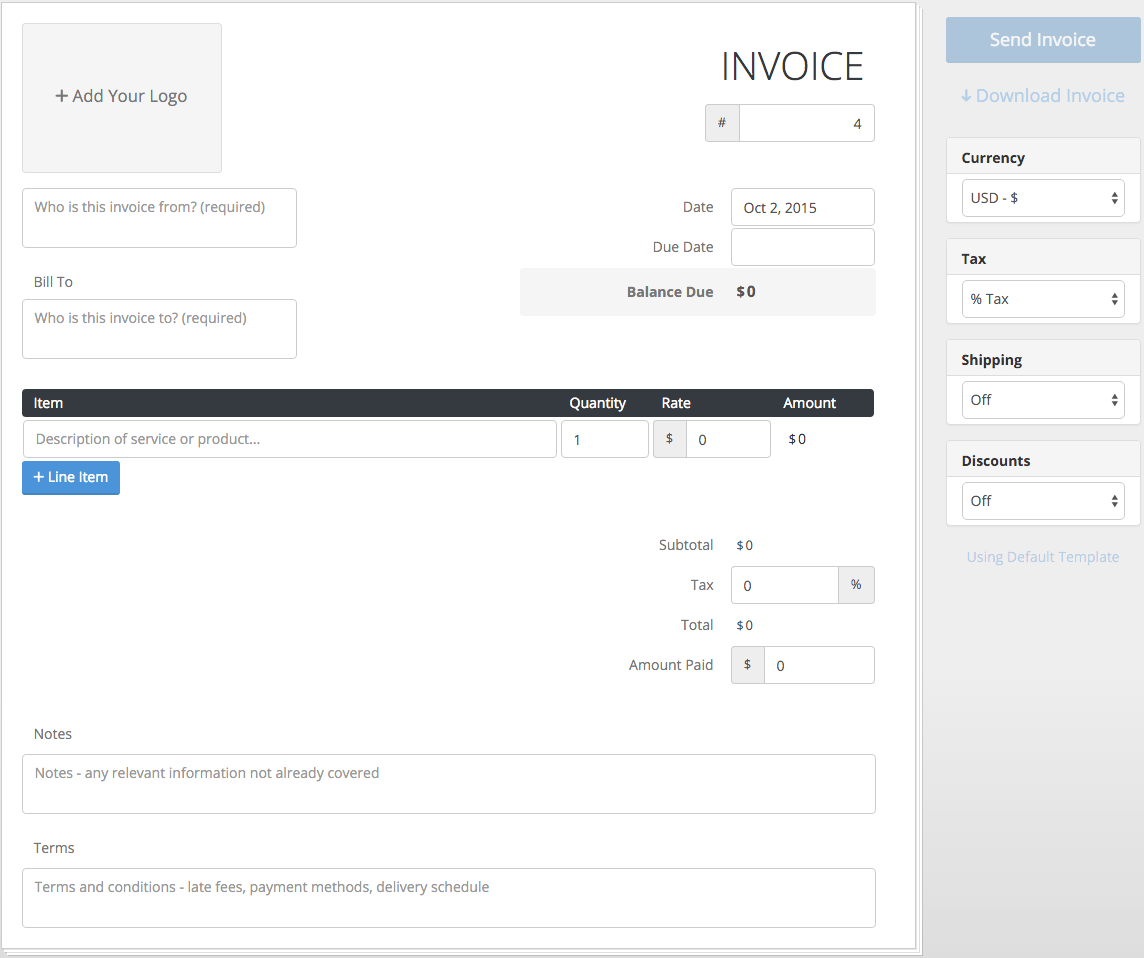

In addition to self-generated options, there are business apps and online, cloud-based services available for freelancers and business owners who want to generate their invoices online. Doing so can be faster and easier than other invoicing options thanks to the simplicity of web-based interfaces and the ability to store and select custom templates.

Generally speaking, there are free invoicing services and paid invoicing services, each with its own benefits.

Our favorite free invoice generation service is called Invoiced Lite, and it’s available at invoice-generator.com. From there, you can create and send invoices via email using one simple form.

It’s easy to use and very fast to set up an invoice — even one that’s customized with your logo and preferred terminology — and the invoices you send are stored online and can also be downloaded as a PDF. It’s possible to set up an invoice template to use over and over again at the site, which can be helpful if you want to customize and save your logo, address, terms, or other aspects of your invoice.

Potential drawbacks of this free invoice generator include the fact that your invoices and templates are stored in your browser history (and will be deleted any time you clear your history), and there’s no built-in method to accept payment, though Invoiced Lite does offer the option to include a “pay by PayPal” button. If you use a service like this, be sure to download copies of each invoice or export your invoice data regularly (a feature invoice-generator.com offers).

But overall, Invoiced Lite is a great tool for freelancers and small businesses who need a free invoicing service.

If you’re looking for an affordable premium service that offers greater functionality and more robust features, consider something like Invoiced. Invoiced offers you the ability to customize invoice templates with your own branding, which goes a long way in keeping your online presence consistent. It also streamlines the process of getting paid by building convenient payment methods right into each invoice you send electronically.

This means you can accept credit cards, PayPal, and even Bitcoin without setting up and managing a complex third-party payment portal — there’s a payment portal function built into your Invoiced account, and each customer receives their own easy-to-use portal to make paying their invoices as convenient as possible. Invoiced also offers tremendously helpful features like recurring billing services, automatic charges, and account statements for your client, all of which can be self-managed.

This means convenience for your clients and faster payments for you two things that help your business run smoothly and make a great impression.

Final thoughts on invoicing

The invoice is a critical business document with a lot of different pieces, but invoicing doesn’t have to be difficult. Consider what your own business invoicing needs are, and find the solution that works best for you. Whether you’re a freelancer who’s been producing individual invoices by hand in Microsoft Word, or an established small business looking for ways to make invoicing more convenient and efficient, there’s an invoicing solution for you.

Do you have questions about invoicing? Post them in the comments or contact us directly for help.