Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a metric that tracks a business’s general profitability or success. Its value does not indicate raw profit but rather the efficiency of a company’s operating performance and the health of its overall cash flow.

Normally, the EBITDA score is considered when valuing a business for sale or acquisition by an outside party. However, banks and other financial institutions commonly leverage EBITDA when considering loans, projecting how easily borrowers can pay debt based on their available working capital.

Let’s explore the significance of this metric, how to calculate it, its disadvantages, and more.

Why is EBITDA important?

EBITDA can be instrumental in assessing a business’s value and a borrower’s capacity to meet debt obligations. That’s because evaluating the profitability or value of a company when compared to other businesses can prove rather complicated; geography, tax requirements, and how individual businesses leverage their debt, equity, and cash might vary between the companies being evaluated, potentially skewing any comparison.

EBITDA attempts to provide a relatively neutral value that ignores much of this nuance, focusing exclusively on operations rather than how much equipment a business might have or the subtleties of regional tax codes.

How to calculate EBITDA

Determining EBITDA is a straightforward process that requires only a calculator and access to your business’s financial statements. In particular, you’ll need the net profit, interest, and tax values from the income statement and the depreciation and amortization figures from the cash flow statement. Of course, depending on how these totals are calculated, you might need to adjust the general line items, focusing specifically on:

- Net profit: This figure will record what is left of the firm’s total revenue after accounting for all of its expenses.

- Interest: Only the interest from short and long-term debt should be considered, ignoring other types, such as interest from accounts receivable (A/R).

- Tax: Specifically income tax, so do not factor in other taxes such as payroll, property, or sales.

- Depreciation and amortization: These account for the gradual, incremental loss of fixed and intangible assets, respectively — often reported as a single line item.

Once you’ve gathered the necessary information, plug it into the following formula to calculate your EBITDA.

EBITDA formula

EBITDA = Net Profit + Interest + Tax + Depreciation + Amortization

or

EBITDA = Operating Income + Depreciation + Amortization

EBITDA example

To put all of this into perspective, imagine that you’re an investor looking for your next opportunity, and after careful consideration, you’ve narrowed your options to one of two local barbecue restaurant chains: Porkpocalypse Inc. and Ribs ‘n Such.

On paper, these organizations appear very similar. They draw in comparable revenues and profits and hold roughly the same value as fixed assets. In addition, since they operate in the same city, they experience an identical income tax burden.

The major difference between the chains is how they fund operations, with Porkpocalypse leveraging debt and Ribs ‘n Such operating entirely on existing equity.

By calculating the EBITDA for these two organizations, you hope to determine which is more efficient at securing profits — a factor that will impact your final decision. And after obtaining the financial statements for both organizations, you begin your calculations.

Porkpocalypse Inc. | |

Net profit: | $235,000 |

Interest: | $45,000 |

Tax: | $117,500 |

Depreciation & Amortization: | $10,000 |

EBITDA: | $407,500 |

Ribs ‘n Such | |

Net profit: | $230,000 |

Interest: | $0 |

Tax: | $115,000 |

Depreciation & Amortization: | $15,000 |

EBITDA: | $360,000 |

By evaluating the relevant EBITDA scores, you quickly realize that Porkpocalypse is noticeably more efficient at capturing value despite recognizing net profits within $5,000 of each other, and you make your investment choice accordingly.

Disadvantages of EBITDA

While useful in the above comparison, EBITDA doesn’t always tell the whole story.

For example, EBITDA ignores asset costs, acting as if any physical resources the business may own will retain their value in perpetuity, absolved from the degradations of use and time. As such, an organization that may have invested heavily in assets might have an attractive EBITDA value, even if it is currently operating at a loss.

Since this metric falls outside of Generally Accepted Accounting Principles (GAAP), how the figure is calculated — namely, what is or isn’t included in the various subtotals — can vary across businesses. Less transparent organizations can use this flexibility to create an inflated image of profitability and performance.

That’s why — to help limit any reporting shenanigans — the U.S. Securities and Exchange Commission (SEC) requires that any publicly-listed U.S. business that shares its EBITDA value must also explain how that figure was derived from its net income.

EBITDA and A/R automation

Your EBITDA depends on the accuracy of your reported financials. You’ll need precise revenue and profit figures that are up-to-date and based on actual data. Unfortunately, using disconnected, manual accounting processes will often invite errors when performing these calculations, particularly if billing or invoice data needs to be rekeyed or transcribed between back-office systems.

An accounting automation platform limits the potential for inaccurate data to undermine your reported totals. You’ll want software that can create automated A/R workflows to manage your invoicing and collection efforts and accelerate the payment process, netting more profit in a shorter period.

Streamlining these operations will help your team to be more efficient, freeing them up for more important tasks.

EBITDA Frequently Asked Questions (FAQ)

What is a good EBITDA?

Since this metric focuses on overall profitability and performance, a higher value is always better. While there isn’t a universally applied target that you should work towards, you will generally want a score higher than your competitors and the industry average.

What is amortization in EBITDA?

While depreciation reflects the gradual wear and tear of physical assets, amortization focuses on the gradual loss in value experienced by intangible company assets. Typically, this will include intellectual property, patents, trademarks, franchise agreements, copyrights, issuing bonds to raise capital, or other organizational costs.

What is the difference between EBITDA, EBT, and EBIT?

A company’s earnings before taxes (EBT) and earnings before interest and taxes (EBIT) are values similar to EBITDA. These values use the same structure but include fewer adjustments. For EBT, you would only add back in the relevant income tax, and for EBIT, you would similarly limit your focus to only interest and income tax.

What is an adjusted EBITDA?

Business is rarely consistent, and there are times when an organization might experience an atypical, non-recurring event that will skew its financial reporting, including its EBITDA value. As such, whoever is evaluating the business might create an adjusted or normalized EBITDA that ignores anomalies like:

- Legal settlements and related fees

- Insurance claims

- Non-cash losses

- Non-recurring income and expenses

- Extraordinary items

What is an EBITDA margin?

An EBITDA margin identifies how much a company’s operating expenses detract from its gross profit. As such, a value greater than 10% is typically considered good, while a lower score might indicate that the organization is vulnerable to financial risk.

EBIDTA margin formula:

EBITDA Margin = EBITDA ÷ Total Revenue

Invoiced: Simplify EBITDA with A/R automation

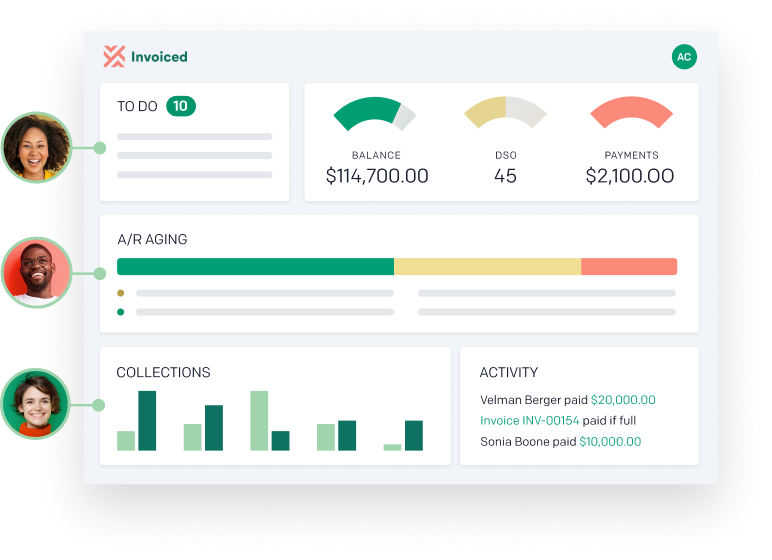

Invoiced gives businesses a simpler alternative to regularly conducting lengthy, in-depth reviews of reporting documents.

With our intelligent Accounts Receivable Automation software, your team can access pre-built reporting tools and create personalized dashboards, streamlining hundreds of objects and field types into an easily digested format.

Seamlessly introduce custom queries to monitor and evaluate the performance of your A/R operations – from EBITDA to A/R KPIs — and identify inefficiencies and drive profitability across your entire business.

Schedule a demo today to see how A/R automation can help simplify your accounting processes.